Monitoring Portfolio News Using AI

June 22, 2025 — One of the enduring challenges of portfolio management is the inability to follow all news flow relevant to portfolio positions. AI and cloud-based workflows are helping

June 22, 2025 — One of the enduring challenges of portfolio management is the inability to follow all news flow relevant to portfolio positions. AI and cloud-based workflows are helping

June 1, 2025 – Amid a fair amount of market tumult, we wrote two months ago that the best course of action was to stay invested in roughly the same

May 16, 2025 — Since the beginning of 2025, the dollar is down a little over 8% relative to a basket of foreign currencies. This represents a small bounce off

May 1, 2025 – While the S&P 500 index was almost unchanged in April, the dollar remained extremely weak, ending the month down over 4%. Since the beginning of February

4/20/2025 — We wrote last year that gold typically does well when the Fed begins a monetary easing cycle. Since that time, the Fed has cut its interest rate target

4/4/2025 — To go along with my LinkedIn post on this topic, here are close-ups of the charts from Google Trends. And here is a figure from Shiller’s paper:

April 2, 2025 – To summarize the market action of March of 2025 in one chart: U.S. stocks (SPX) did poorly, international stocks (especially Europe, VGK) did well in dollar

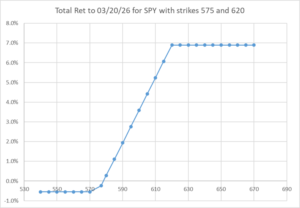

March 18, 2025 — In a recent piece, we analyzed the construction of downside protected strategies. Here we propose a measure of the relative attractiveness of these strategies over time

March 4, 2025 — Recently, downside protected ETFs have garnered a lot of investor attention. These products are long the stock market—via different indexes—and use options to create downside-protected payoffs.

An increase in “unusual” news with negative sentiment predicts an increase in stock market volatility. Unusual positive news forecasts lower volatility. Our analysis is based on over 360,000 articles on 50 large financial companies, published during the period of 1996–2014…

We develop a classification methodology for the context and content of news articles to predict risk and return in stock markets in 51 developed and emerging economies. A parsimonious summary of news, including topic-specific sentiment, frequency, and unusualness (entropy) of word flow…

We analyze methods for selecting topics in news articles to explain stock returns. We find, through empirical and theoretical results, that supervised Latent Dirichlet Allocation (sLDA) implemented through Gibbs sampling in a stochastic EM algorithm will often overfit returns to the detriment…

In the movie “True Lies,” Arnold Schwarzenegger plays the role of a skilled spy. In one scene, he is injected with truth serum in preparation for interrogation. Under the influence of the truth serum, he reveals how he plans to kill his captors and escape and then applies his skills and weapons…

We develop a model of information and portfolio choice in which ex ante identical investors choose to specialize because of fixed attention costs required in learning about securities. Without this friction, investors would invest in all securities and would be indifferent across a wide range of information choices…

We develop a model of investor information choices and asset prices where the availability of information about fundamentals is time-varying. A competitive research sector produces more information when more investors are willing to pay for that research…

Technical analysis, also known as charting,’ has been part of financial practice for many decades, but this discipline has not received the same level of academic scrutiny and acceptance as more traditional approaches such as fundamental analysis. One of the main obstacles is the highly subjective nature of technical analysis…

The well-documented underreaction of stock prices to news exhibits substantial time variation. We show that higher risk-bearing capacity of financial intermediaries, lower passive ownership of stocks, and greater informativeness of news increase price responses to contemporaneous news…

We study the performance of many traditional and novel, text-based variables for in-sample and out-of-sample forecasting of oil spot, futures, and energy company stock returns, and changes in oil volatility, production, and inventories. After controlling for small-sample biases, we find evidence of in-sample predictability…

The initial phase of the COVID-19 pandemic was characterized by voluminous, highly negative news coverage. Markets overreacted to uninformative news, and reacted more to news during high volatility periods. News coverage responded to lagged market activity, and causally impacted contemporaneous returns…

By submitting this form, you agree to receive informational, service-related, and marketing emails from QuantStreet. You can unsubscribe at any time by contacting us or using the unsubscribe link in any email. You also confirm that you have read and agree to our Terms of Use and Privacy Policy.