4/20/2025 —

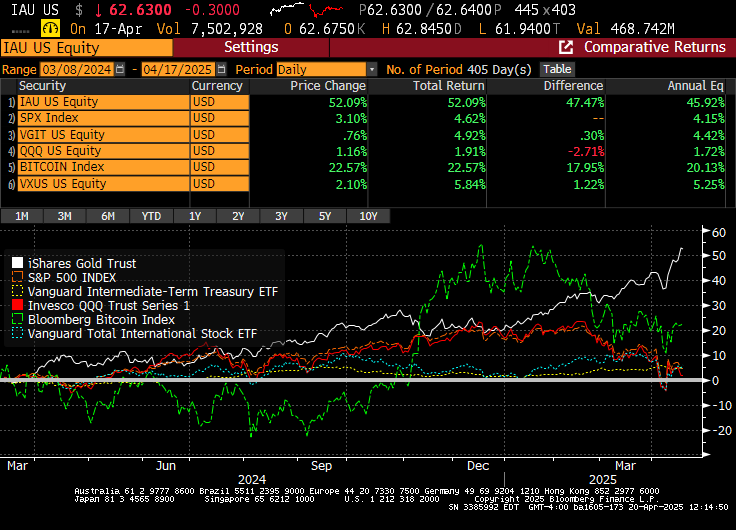

We wrote last year that gold typically does well when the Fed begins a monetary easing cycle. Since that time, the Fed has cut its interest rate target by 1%. And gold (IAU) has been one of the best performing asset classes with gains outstripping the S&P 500 index (SPX), Treasuries (VGIT), Nasdaq (QQQ), bitcoin, and global stock ex-U.S. (VXUS).

Source: Bloomberg

Gold’s strong performance over the prior year, and especially recently, has had a lot to do with the uncertainty brought about by the Trump administration’s trade policy. Since President Trump’s April 2nd “Liberation Day” tariff announcement, gold is up 6.2% while U.S. stocks are down close to 7% and international stocks and bitcoin are down around 2%.

Pros

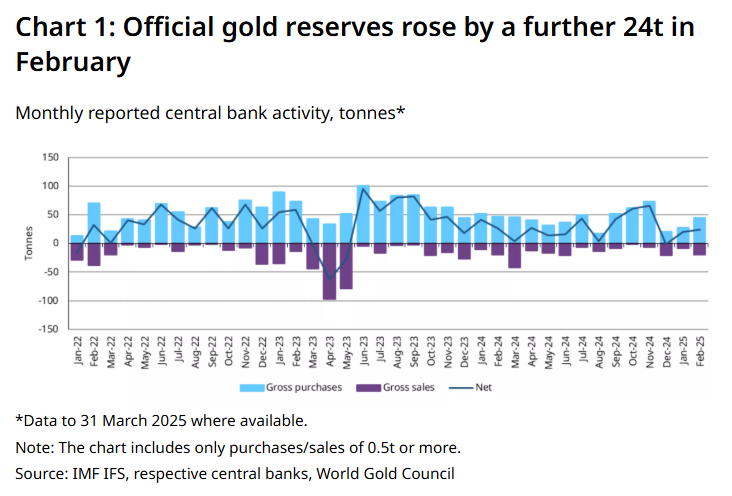

One of the drivers of gold’s performance has been persistent buying by global central banks. The next chart, obtained from the World Gold Council, shows that central banks have been net buyers of gold for the last several years, a trend that might accelerate given recent market turmoil caused by trade uncertainty (the data for March and April are not yet available).

Gold’s traditional role as a hedge against market and economic uncertainty can be seen through two statistical measures:

- Gold’s daily price changes have very low correlations with price changes of other asset classes. For example, over the last year, the correlation of daily gold and S&P 500 returns has been 21%, whereas the correlation of bitcoin and S&P 500 returns has been 46%. This low correlation means gold is a diversifying influence in investor portfolios. (Interestingly, gold’s correlation with daily bitcoin returns over the last year is only 10%.)

- Gold tends to do well in bad 12-month return periods for the overall market. In 1-in-20 bad 12-month return periods for the S&P 500—when the S&P 500 is down 25% on average—gold’s average return has been a positive 2%.

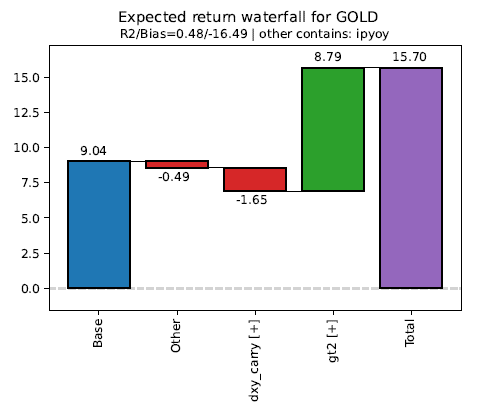

QuantStreet’s machine learning forecasting model is presently bullish on gold. The model identifies several forecasting variables for each tracked asset class. For gold, the model identifies the U.S. vs. Germany interest rate differential (dxy_carry) and the level of two-year Tresury yields (gt2) in the U.S. as important forecasting variables. The currently elevated—relative to its history in the model training window—level of two-year yields generates a high one-year ahead return forecast.

Source: QuantStreet

One possible mechanism to explain this relationship is that when two-year rates are high, it is relatively expensive to own gold, relative to keeping money in a money market fund, so there is lower gold demand. As interest rates fall, the carry cost of owning gold diminishes and the demand curve shifts outward, leading to higher prices in the short-term. This is also related to our prior finding that gold does well when the Fed eases, i.e., when short-term rates, like the two-year, fall.

Adding weight to the gold investment thesis is that QuantStreet’s forecasting model for gold has good out-of-sample forecasting properties, as seen by its out-of-sample R-squared (a measure of the goodness of fit of future one-year return forecasts versus actual one-year ahead return outcomes) of 48%.

Cons

A gold investment is supported by its role as a hedge against uncertainty and market downturns, central bank buying, its low correlation with other risk assets, and the currently high level of two-year rates relative to the training window of the model. But one factor that cautions against a gold position is its high past year return. We update a chart from our prior analysis of gold which shows the gold price (coming from the first maturity gold futures contract) relative to the level of the CPI price index (which measures the aggregate price level in the U.S. used for calculating inflation). The gold-to-price-level ratio is at 9.77, which is an all-time high dating back to the mid-1970s. Last year we also mentioned this elevated level as a concern for the gold thesis, though at that time the ratio was only at 6.77.

Source: Bloomberg

Relative to prior decades, gold is now much easier to own thanks to highly liquid ETFs, such as IAU or GLD, which allow investors to easily increase or decrease their exposures to gold. Adjusting for this easy accessibility to gold might make the current valuation level seem less extreme historically, but this is beyond the scope of the present analysis.

Another factor in favor of gold as a portfolio hedge is the gold-to-bitcoin ratio, which now stands at 0.039, quite a bit higher than last year’s ratio, but still well off recent highs established in late-2022.

Source: Bloomberg

Conclusion

Gold has been a high-performing investment over the prior year. It has rallied on the back of falling short-term interest rates and recently increased uncertainty about global trade and economic growth. Several factors argue in favor of gold’s inclusion in investor portfolios, but the elevated valuation level of gold (relative to the inflation price index) argues for some caution. Nevertheless, we continue to hold gold in QuantStreet’s portfolios, though we regularly evaluate the investment thesis and other relative opportunities, and our holdings of gold may decrease or increase in the coming weeks and months.

Working with QuantStreet

QuantStreet is a registered investment advisor. It offers financial planning, separately managed accounts, model portfolios and portfolio analytics, as well as consulting services. The firm’s approach is systematic, data-driven, and shaped by years of investing experience. To work with or learn more about QuantStreet, contact us at hello@quantstreetcapital.com or sign up for our email list.

The above analysis is for educational purposes only. None of the above should be considered investment advice. Please evaluate every investment in the context of your own risk preferences and liquidity needs.