July 2025 Update

July 3, 2025 – After a tumultuous few months, June of 2025 saw a strong rally which took global markets to (or close to) new highs. The rally was broad-based, with international and U.S. markets all up strongly. Leading the pack were emerging market stocks, followed by communications and technology. International stocks continued to do […]

Monitoring Portfolio News Using AI

June 22, 2025 — One of the enduring challenges of portfolio management is the inability to follow all news flow relevant to portfolio positions. AI and cloud-based workflows are helping us overcome this problem. In my years trading on Wall Street, I was always bothered by the fact that, even with a small number of […]

June 2025 Update

June 1, 2025 – Amid a fair amount of market tumult, we wrote two months ago that the best course of action was to stay invested in roughly the same portfolios that we’ve had throughout, and let the market stabilize. This stabilization started in May as many of 2025’s laggards rallied, including, at long last, […]

What’s Happening with the Dollar?

May 16, 2025 — Since the beginning of 2025, the dollar is down a little over 8% relative to a basket of foreign currencies. This represents a small bounce off its lows from mid-April (at which point the dollar was down over 10% from its January high). While the dollar has been weak all year, […]

May 2025 Update

May 1, 2025 – While the S&P 500 index was almost unchanged in April, the dollar remained extremely weak, ending the month down over 4%. Since the beginning of February 2025, the S&P 500 index is down 6%, though this reflects a large bounce off the early-April lows. The dollar, on the other hand, is […]

The Gold Investment Thesis Revisited

4/20/2025 — We wrote last year that gold typically does well when the Fed begins a monetary easing cycle. Since that time, the Fed has cut its interest rate target by 1%. And gold (IAU) has been one of the best performing asset classes with gains outstripping the S&P 500 index (SPX), Treasuries (VGIT), Nasdaq […]

Narrative Epidemics

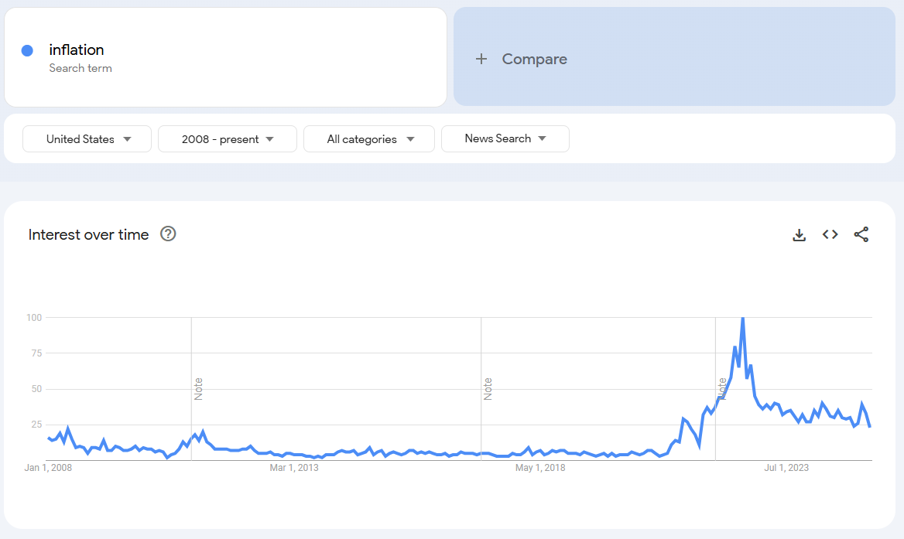

4/4/2025 — To go along with my LinkedIn post on this topic, here are close-ups of the charts from Google Trends. And here is a figure from Shiller’s paper:

April 2025 Update

April 2, 2025 – To summarize the market action of March of 2025 in one chart: U.S. stocks (SPX) did poorly, international stocks (especially Europe, VGK) did well in dollar terms, and gold (IAU) did spectacularly well. The main culprit appears to market concerns about the Trump administration’s tariff policies. President Trump’s 4pm tariff announcement […]

Downside Protected Strategies: Relative Value

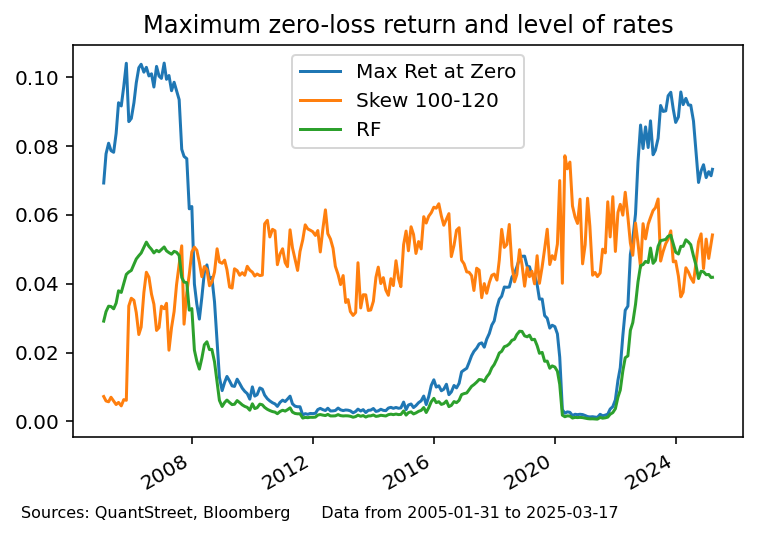

March 18, 2025 — In a recent piece, we analyzed the construction of downside protected strategies. Here we propose a measure of the relative attractiveness of these strategies over time and examine their historical performance. To briefly recap, using one-year T-bills and call options (or using the underlying stock and one-year put and call options), […]

Downside Protected Strategies

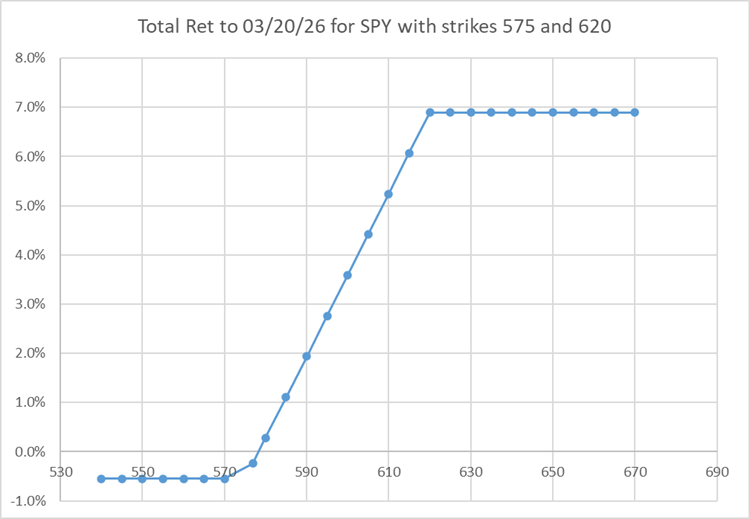

March 4, 2025 — Recently, downside protected ETFs have garnered a lot of investor attention. These products are long the stock market—via different indexes—and use options to create downside-protected payoffs. To take one example, Calamos offers CPSR, a downside protected ETF tied to the S&P 500 index with a payout on or before February 27, […]