February 2026 Update

February 1, 2026 – Our recent piece on the dollar neatly lays out much of what drove price action in January of 2026. Despite a disastrous last trading day in

Visit our Substack for additional market research and analysis.

Important Disclosures: The articles and commentary on this page are provided for informational and educational purposes only and do not constitute investment or tax advice. Please consult with the appropriate professional before making investment or tax decisions. Investing in financial markets involves risks. Investors may lose money. No investment strategy can ensure a profit or protect against loss in adverse or unexpected market conditions. Please visit this page for additional important disclosures and information regarding your use of this content.

February 1, 2026 – Our recent piece on the dollar neatly lays out much of what drove price action in January of 2026. Despite a disastrous last trading day in

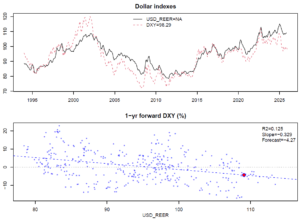

January 25, 2026 — Dollar positives include relatively high US interest rates and robust growth. But dollar negatives are building. The political will for a stronger dollar isn’t there and

January 3, 2026 – With 2025 in the books, we take a brief pause to reflect on QuantStreet over the last few years. We started managing our first portfolio in

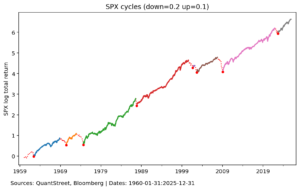

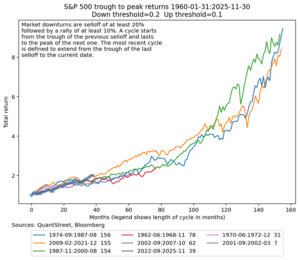

December 15, 2025 — The S&P 500 is near all-time highs, leading some to question whether markets are in a bubble. A careful analysis of past bull markets suggests this

December 10, 2025 – Markets had a mini swoon in November, on the back of AI bubble concerns (more on this below). But the recovery was quick and thus far

November 17, 2025 — Carlota Perez, in her book Technological Revolutions and Financial Capital, argues technological revolutions occur in (roughly) 50-year cycles. She identifies five such episodes, starting with the

November 2, 2025 – October was a good month for financial markets, with a broad-based rally across geographies and sectors. Tech stocks and gold led the way, and the dollar

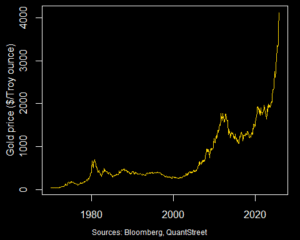

October 26, 2025 — At QuantStreet, we’ve had an allocation to gold across our portfolios for the last year and a half. [1] Our investment thesis, laid out in our

October 5, 2025 – The market is in a funny place. September was a strong month for financial markets, its typical negative seasonality notwithstanding. However, news narratives over the last

An increase in “unusual” news with negative sentiment predicts an increase in stock market volatility. Unusual positive news forecasts lower volatility. Our analysis is based on over 360,000 articles on 50 large financial companies, published during the period of 1996–2014…

We develop a classification methodology for the context and content of news articles to predict risk and return in stock markets in 51 developed and emerging economies. A parsimonious summary of news, including topic-specific sentiment, frequency, and unusualness (entropy) of word flow…

We analyze methods for selecting topics in news articles to explain stock returns. We find, through empirical and theoretical results, that supervised Latent Dirichlet Allocation (sLDA) implemented through Gibbs sampling in a stochastic EM algorithm will often overfit returns to the detriment…

In the movie “True Lies,” Arnold Schwarzenegger plays the role of a skilled spy. In one scene, he is injected with truth serum in preparation for interrogation. Under the influence of the truth serum, he reveals how he plans to kill his captors and escape and then applies his skills and weapons…

We develop a model of information and portfolio choice in which ex ante identical investors choose to specialize because of fixed attention costs required in learning about securities. Without this friction, investors would invest in all securities and would be indifferent across a wide range of information choices…

We develop a model of investor information choices and asset prices where the availability of information about fundamentals is time-varying. A competitive research sector produces more information when more investors are willing to pay for that research…

Technical analysis, also known as charting,’ has been part of financial practice for many decades, but this discipline has not received the same level of academic scrutiny and acceptance as more traditional approaches such as fundamental analysis. One of the main obstacles is the highly subjective nature of technical analysis…

The well-documented underreaction of stock prices to news exhibits substantial time variation. We show that higher risk-bearing capacity of financial intermediaries, lower passive ownership of stocks, and greater informativeness of news increase price responses to contemporaneous news…

We study the performance of many traditional and novel, text-based variables for in-sample and out-of-sample forecasting of oil spot, futures, and energy company stock returns, and changes in oil volatility, production, and inventories. After controlling for small-sample biases, we find evidence of in-sample predictability…

The initial phase of the COVID-19 pandemic was characterized by voluminous, highly negative news coverage. Markets overreacted to uninformative news, and reacted more to news during high volatility periods. News coverage responded to lagged market activity, and causally impacted contemporaneous returns…