May 3, 2024 —

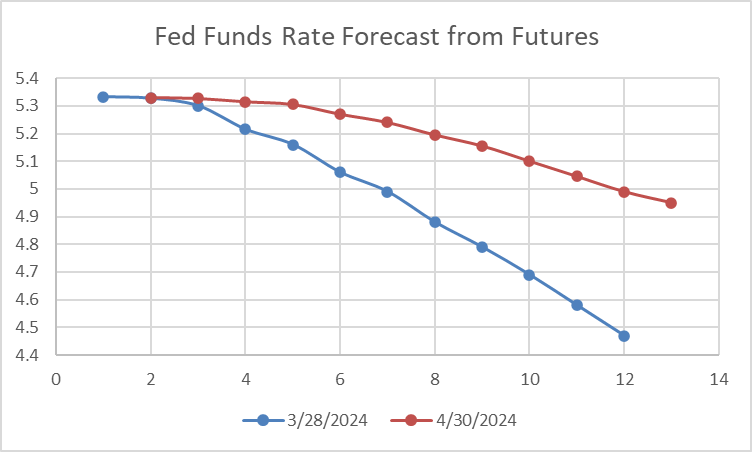

From the end of March until the end of April, the market had a serious rethink about the path of monetary policy for the rest of 2024. March ended with the market pricing in three 25 basis-point rate cuts by the Fed over the next 12 months. As we’ve written in the past, such Fed monetary policy easing is typically associated with robust stock market outcomes. Fast forward to the end of April, and the market’s new assessment of year-ahead Fed easing stands at a single 25 basis-point rate cut. The next chart shows the path of monetary policy forecast by Fed funds futures markets as of the end of March (blue line) and the end of April (red line). Each notch in the charts represents one month. Notice the dramatic rise in the market’s expectation of future policy rates that took place in April.

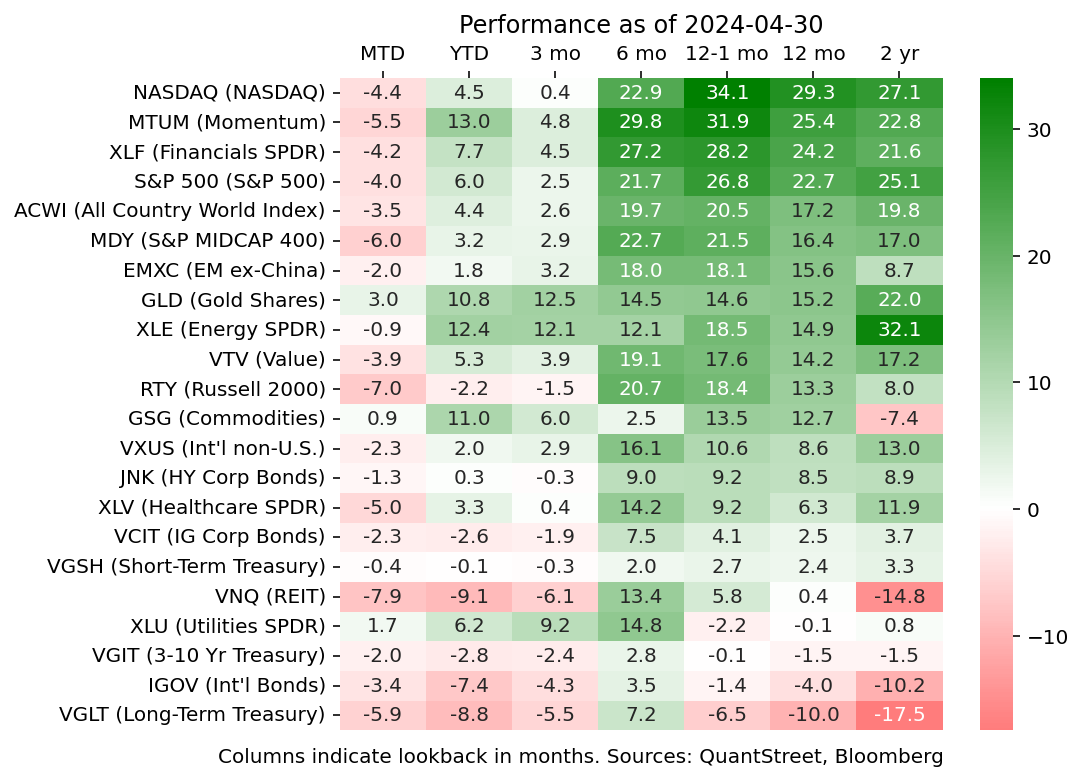

The culprits behind this reassessment are a strong labor market in the U.S. and stubbornly persistent inflation. Given the association between Fed easing and anticipated strong stock and bond market performance, this Fed policy reassessment was associated with a pretty bad month for risk assets. The next table shows the performance of different risk assets over different time horizons. The MTD column corresponds to April’s returns, while the other columns correspond to year-to-date, 3-month, 6-month, past-year excluding the most recent month (12-1 mo), past-year, and past two-year returns. While the medium to longer term return trends remain quite positive, April’s returns were very weak, with the S&P 500 down 4%, the Nasdaq down 4.4%, REITs and small caps (Russell 2000) down 7% or more on the month.

Since this sell-off was sparked by concerns over inflation and faster-than-expected economic growth, bonds were not spared, with medium duration Treasuries (VGIT) down 2% and long-duration Treasuries (VGLT) down 5.9%. One of the few things that was up on the month was gold, as asset class that we’ve been bullish on for the last two months.

QuantStreet’s performance across our different risk-level strategies was also down on the month, though we moved in line with our benchmarks (details here).

Research

On the research side, we highlight three recent pieces. First, we investigated the current capabilities of AI models to help investors make better qualitative decisions. The results are promising, but are not yet the level of a competent human analyst (though the speed of improvement is breathtaking). We next looked at industry momentum, which is the tendency of sectors with high past stock returns to continue to perform well and the tendency of sectors with low past stock returns to continue to perform poorly. You might be wondering what time period “past” refers to, and this is what we investigate in the research piece. Our finding is that returns over the past three months and over the past year but excluding the most recent month are the two measurement horizons with the best predictive power. In fact, the performance table you see above — with return trends shown across different time horizons — is motivated by the findings from our industry momentum research.

Finally, we investigate whether inflation-protected U.S. Treasuries (TIPS) are riskier or safer than nominal (i.e., regular) U.S. Treasuries. The answer is that TIPS have outperformed comparable maturity nominal Treasuries over the last 25+ years while also providing a hedge against inflation. However, they are considerably more cyclical than their nominal counterparts and do not provide the downside market hedge that people expect from nominal Treasuries. Overall, TIPS likely have an important role to play in some investors’ portfolios, but they are not a free lunch.

To receive future research reports in real-time, please sign up for QuantStreet’s Substack page.

Looking ahead

Across all risk levels, our positioning for the month ahead is largely in line with our positioning last month. We slightly decreased the duration of our Treasury holdings to make room for a slightly increased allocation to equities while maintaining our risk targets (i.e., lower duration freed up a bit of risk capital which was allocated to stock positions).

Our macro view remains that a lot of tightening has already been introduced into the system by the Fed. Just look at 30-year fixed mortgage rates, for example.

The economy remains resilient but at some point the growth cracks will start to show (e.g., Friday’s weaker-than-expected payrolls number). The Fed will eventually cut rates, which has historically been associated with strong performance of risk assets (and gold). This is how our portfolios continue to be positioned.

Working with QuantStreet

QuantStreet offers wealth planning, separately managed accounts, model portfolios and portfolio analytics, as well as consulting services to our clients. If you are an existing client or if you are thinking about working with us, we’d love to hear from you. Please reach out to us at hello@quantstreetcapital.com.

Photo by Gemini.