June 2, 2024 —

After a weak April, markets bounced back in May, with the S&P 500 staging a breathtaking rally in the final few hours of trading on Friday, May 31.

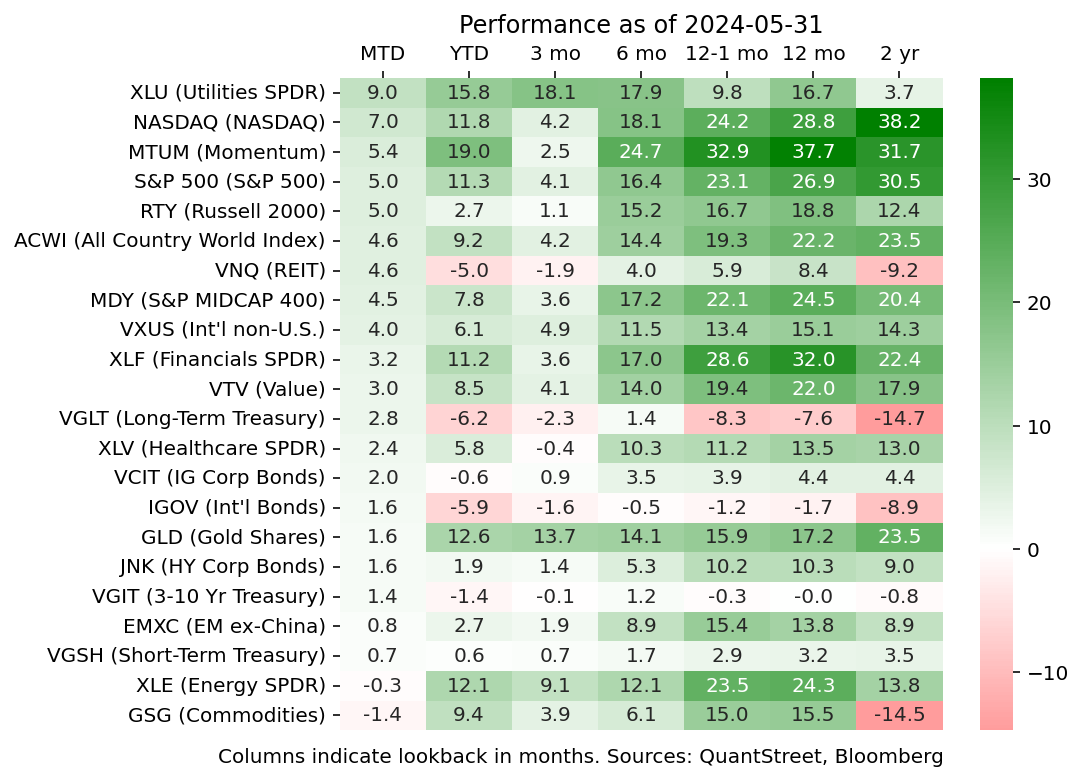

For the month, most asset classes were up, with utilities outpacing even the tech-heavy NASDAQ to be the monthly performance leader (more on this below). The S&P 500 was up a robust 5% on the month. Fixed income did relatively well as well as 10-year Treasury rates dropped from 4.68% to 4.5% on weaker-than-expected employment data and a better CPI inflation report in mid-May. The laggards were energy stocks and commodities.

QuantStreet’s performance was strong in May, with all three of our live strategies–the 60/40, 85/15, and 95/5 risk levels–outperforming industry-leading asset allocation mutual funds that operate at these respective risk levels. You can read more about our performance here.

What’s going on with utilities?

For those who follow utility stocks, it may be surprising to see this usually staid part of the market emerge as the monthly performance leader. The reasons here are twofold. First, and likely less importantly, utilities have underperformed the broader market for a while now, and based on some valuation metrics, like price-to-book ratios, utilities look relatively cheap (we are not big believers that valuation metrics are particularly good at forecasting future price returns, so take this observation with a grain or two of salt). The second reason, and likely much more relevant for the strong rally, is that investors are coming around to the idea that the emergence of AI and the recent trend towards onshoring are going to leave the U.S. economy short of energy generation and transportation capacity. Thus, utilities are becoming the hot new thing. Two recent pieces about this are well worth reading: one from Jason Zweig at the WSJ and the other from Goldman Sachs.

Coupled with utilities’ diversifying presence in a portfolio–its correlation with other asset classes is quite low–QuantStreet’s sanguine model return forecast for the sector, and the newly emerged catalyst of both a positive trend and a good narrative, we are adding utilities exposures to our portfolios across most risk levels for the coming month. To make room for this new portfolio addition without violating our portfolios’ risk budgets, we are reducing our exposure to Treasuries and QQQs. Given utilities’ newfound exposure to AI, we believe our portfolio remains positively exposed to AI despite this month’s partial reallocation from QQQs to utilities.

Research and other happenings

Our main research work in the past month was to examine the U.S. debt load in the context of other developed market economies over the last 150 years. This research is made possible by an amazing data set that is freely available at macrohistory.net. While fully understanding U.S. sovereign debt dynamics is certainly well beyond the scope of our short article, the long-term, global context does provide some degree of comfort. First, the U.S. debt-to-GDP ratio of 120%, while high, is not unprecedented either for the U.S. or globally. Second, a more relevant measure of the cost of debt is the debt-service-to-GDP ratio, and by this metric (or an approximation thereof) the U.S. looks downright prudent.

Of course, as rates rise, the cost of debt service will as well, as new borrowing happens at higher rates than old borrowing. Nevertheless, the U.S. seems to have a very long runway before its current level of deficit spending leads to funding problems. Nevertheless (again), the U.S., and in particular our political leaders, will have to moderate spending at some point, otherwise our debt load will push us into a vicious cycle of higher borrowing and higher borrowing costs. But we are a long way from that state of affairs, and I am hopeful that we will change our behavior long before things turn bad. If you would like to receive our research pieces in real time, please sign up for our Substack page.

About a week and a half ago, Harry had the pleasure of attending the Q4 Top RIA Forum in Florida where he gave a keynote address on the emerging uses of AI in finance. Our view is that there will be bumps on the road, but the AI revolution is going to transform the practice of finance, and our society more broadly. Being at the meeting and listening to and talking to the other participants brought home to us just how much innovation is happening in the RIA space. We, at QuantStreet, hope that our model portfolios and machine-learning based analytics are making a contribution to this innovation stream. Our view is that those advisors who embrace the tools of AI and machine learning will outcompete those advisor who do not because they will be better able to serve their clients’ needs.

Certainly our commitment at QuantStreet is to help our RIA and wealth management clients take advantage of the new analytical advances that are all around us and to achieve better portfolio outcomes at the risk and liquidity levels that are appropriate for them.

Working with QuantStreet

QuantStreet offers wealth planning, separately managed accounts, model portfolios and portfolio analytics, as well as consulting services to our clients. Our approach is systematic and data-driven, but also shaped by years of investing experience. If you are an existing client or if you are thinking about working with us, we’d love to hear from you. Please reach out to us at hello@quantstreetcapital.com.

Cover picture by Gemini.