January 1, 2024 —

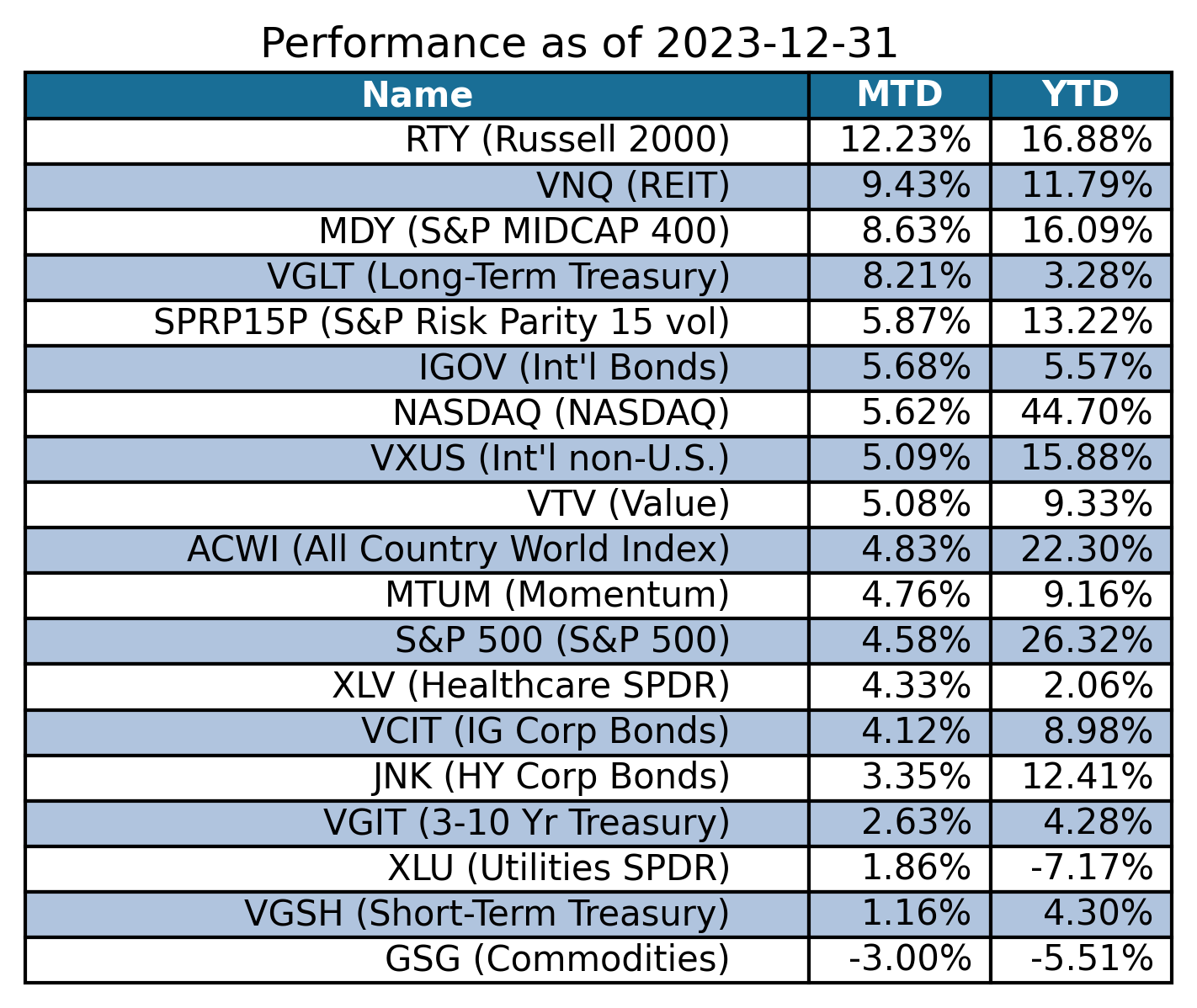

December 2023 saw a continuation of November’s rally, though the December winners tended to be the year’s laggards. For example, long-term Treasuries, which were having an otherwise less-than-great year, were up over 8% in December, after rallying over 9% in November. The Russell 2000, another 2023-laggard, led the way in December with a gain of over 12%, which left small caps up just shy of 17% for the year. Midcaps also had a big catch-up rally in December, up almost 9%, bringing their year-to-date gain to over 16%. The year’s big winners, the S&P 500 and Nasdaq, had a perfectly respectable December, but were not the month’s leaders. The same can be said of QuantStreet’s December performance: pretty good but not the month’s leader (you can see our detailed performance numbers here).

QuantStreet’s models are particularly enamored of S&P 500 and Nasdaq at the moment — which leaves us long the year’s winners — and those two represented and continue to represent the bulk of our equity exposures across the different risk-level portfolios headed into 2024. Rounding out our portfolios are some international and (newly established) emerging market ex-China equity exposures, and positions across short- and medium-duration Treasuries. We fully closed out our long-term Treasury exposure following the large rally in that part of fixed income markets over the last two months.

Research

In December, we published a piece on Advisor Perspectives arguing that the impending economic slowdown will be good for risk assets. We also wrote a piece on QuantStreet’s Substack site where we analyzed what happened in markets following past sector-level booms, like the one experienced by tech stocks in 2023. Historically, sector booms are as often followed by a continuation of the boom as they are by busts. Given the fundamentals underpinning the tech rally in 2023 and an impending economic slowdown which will likely be associated with Fed monetary easing, we remain sanguine on risk assets headed into 2024.

Of course, forecasting the overall market direction is a very imprecise undertaking, so such forecasts should be taken with a grain (or two) of salt.

Looking ahead to 2024

2023 was an important growth year for us at QuantStreet. We signed many retail clients and several institutional clients for our model portfolio and advisory services. We are currently in discussions with prospective new clients on the retail and institutional side, as well as with several potential partners who can help us broaden our distribution and refine our technology processes. Our ultimate goal is to provide QuantStreet’s clients with world-class financial advice and investment outcomes. We greatly appreciate the trust our clients have put in us, and we plan to work very hard in 2024 to do well for our clients.

If you are an existing client or if you are thinking about working with us, we’d love to hear from you. Please reach out to us at hello@quantstreetcapital.com.

(The featured image is thanks to BoliviaInteligente on unsplash.com).