December 4, 2023 —

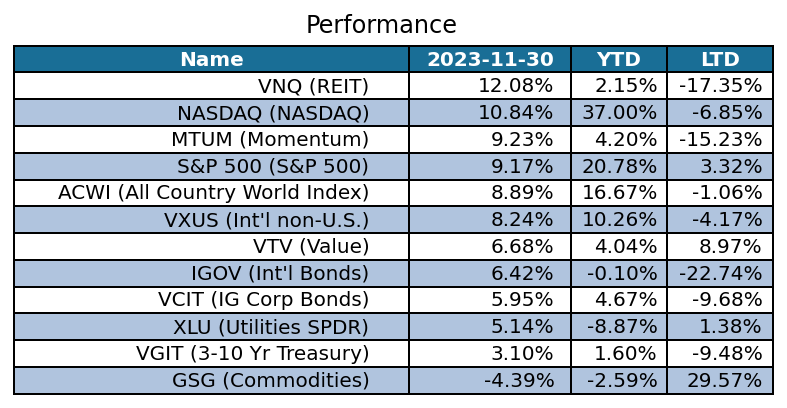

November of 2023 was significant for us on two levels. First, it was a very strong month for financial markets. Outside of a few pockets of weakness (notably commodities), just about everything was up and it was up a lot.

QuantStreet’s portfolios also did well in November (more on that below). The catalysts for this performance were emerging indicators of moderately slowing economic growth, which sets up a Goldilocks scenario of lower inflation, a moderate but not severe slowdown, and falling interest rates. As we wrote in a recent Substack piece, this is a great backdrop for financial markets. The other notable event marked by the end of trading in November of 2023 was QuantStreet’s 2-year anniversary of running separately managed accounts for our clients.

Looking back

QuantStreet has experienced steady growth in this past year. Most recently, we have made our model portfolios available to asset managers and financial advisors, allowing them to leverage our systematic and rigorous portfolio construction process for their own clients. We have also continued to bring on individual clients for whom we invest separately managed accounts and provide financial planning services. What has been most rewarding about what we do at QuantStreet is that we are tangibly helping investors improve financial outcomes for themselves and for their families. It is a privilege to do such work.

We now run three strategies in our separately managed accounts. Our longest running strategy targets a risk level in line with an 85% stock and 15% U.S. Treasury bond portfolio. This strategy has been live since December 1, 2021 — thus our two-year anniversary! We have also been running a portfolio with a risk level in line with a 95% stock and 5% bond allocation. This has been live since November 2022. Finally, we recently introduced a 60/40 stock/bond risk level portfolio, which has been live since August of 2023. We benchmark each portfolio against asset allocation mutual funds which can invest in U.S. and international stocks and bonds, and which target similar risk levels to our strategies.

Our 85/15 strategy has outperformed its benchmarks (funds run by Fidelity, Vanguard, Blackrock, and so on) by between 4.5% to 10.5% on an after-fee basis since we launched the strategy two years ago. The 95/5 strategy has outperformed its benchmarks by 0.4% to 1.3% on an after-fee basis since its launch in November of 2022. And the 60/40 strategy, on a post-fee basis, is running at 0.20% below one benchmark but outperforming five others in the four months since its launch. Overall our data- and analytics-driven, active asset allocation process is proving its worth in our clients’ portfolios. You can find more details about our performance here.

Looking ahead

We wrote in a November piece on Advisor Perspectives that long-dated, low-coupon Treasury bonds were an attractive investment. This trade, implemented using the VGLT ETF which invests in long-duration Treasury bonds, performed well in November. Our VGIT position, an ETF which invests in medium-term U.S. Treasuries, also did well based on the same dynamics discussed in the article.

For December, we have slightly shortened the duration of our Treasury exposures in response to November’s large rally in fixed income. Our international fair-value interest rate model still thinks U.S. rates are high relative to their fair-value benchmark — suggesting that owning Treasury bonds remains a good trade — but the degree of mispricing is lower than it was in November, so we are slightly lightening up on the average maturity of our bond holdings. Because short-dated Treasuries are less volatile than long-dated Treasuries, this portfolio shift has freed up some of the risk budget in our model portfolios, which has allowed for a slight increase in equity allocations. As we wrote on our Substack, the current macro and Fed monetary policy environment suggest a good backdrop for risk assets, so we think a slight increase in equity exposure is warranted.

Looking beyond just December and into the new year, we are exploring several partnership opportunities to grow our distribution channels and are in active discussions with potential new clients. In the year ahead, we hope to continue our growth while adding value to asset managers and financial advisors, and effectively serving our individual clients and their loved ones.

Please reach out to us at hello@quantstreetcapital.com with any questions.

(The featured image is thanks to Jason Leung on unsplash.com).