December 14, 2022 —

With the December 14, 2022 Federal Reserve policy decision out of the way – and largely in line with expectations – we can take a step back and look at where U.S. monetary policy is vis-a-vis other central banks.

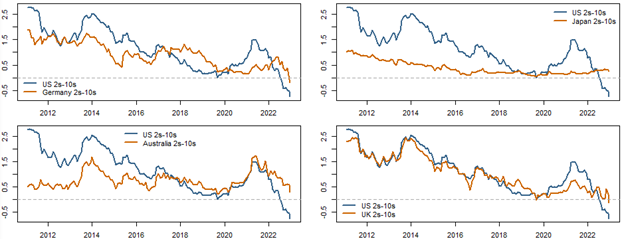

Figure 1 shows the U.S. 2s-10s curve (10-year government bond yields minus 2-year government bond yields) alongside those from the U.K., Germany, Australia, and Japan. The U.S. 2s-10s curve is considerably more inverted the 2s-10s curves of these other countries.

Figure 1: U.S. Versus Global 2s-10s Curves

Sources: Bloomberg, QuantStreet

2-year rates reflect anticipation of short-term central bank policy, whereas 10-year rates reflect longer term growth and inflation expectations. When the 2-year rate is far above the 10-year rate, monetary policy is highly restrictive. The comparison in Figure 1 therefore shows that the Fed has already done much more of the tightening work than its global peers.

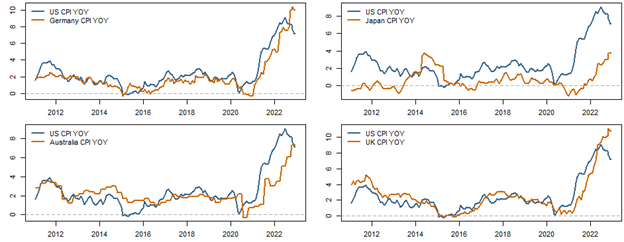

The other important dynamic is that U.S. last-12-month inflation (CPI YOY) has turned down, whereas the comparable inflation measures in other countries continue to increase.

Figure 2: U.S. Versus Global Last-12-Month Inflation

Sources: Bloomberg, QuantStreet

The takeaway of all this is that the U.S. is several months or quarters ahead of other countries in its battle against inflation. This also suggests that U.S. monetary policy will turn (ease) more quickly, which in turn means U.S. growth is likely to accelerate sooner than growth in U.K., Germany, Japan, and Australia.

From the point of view of a U.S. investor, owning international stocks entails exposure to international stock price fluctuations in their local currencies, as well as to the exchange rate of the international currencies against the dollar. When the dollar depreciates against foreign currencies, as it has done recently after a long period of appreciation, this gives a tailwind to international stocks held by U.S. investors, because those stocks mechanically appreciate in dollar terms due to the currency impact. This dynamic would seem to favor international stock holdings.

The other dynamic is economic growth. If U.S. monetary policy begins to ease first, which now seems likely, U.S. economic growth will outpace that of other countries. This will be boost U.S. corporate earnings relative to that of international firms. That will provide a strong tailwind to the U.S. stock market relative to global stocks, though this may be somewhat offset by a depreciating dollar.

Net-net, the U.S. seems so far in front of front of other countries in this economic cycle, that the earnings effect may well dominate, leading to continued outperformance of U.S. stocks relative to international peers.

Dr. Harry Mamaysky is the CIO of QuantStreet Capital and a Professor at Columbia Business School. QuantStreet uses the latest advances in data science, machine learning, and financial economics to tactically allocate across major liquid asset classes using ETFs.