October 20, 2022 —

The Problem with Pundits

It’s fashionable for pundits to comment on the dire state of the global economy. Out-of-control inflation. Deglobalization. Imprudent fiscal policy by newly elected conservative governments in Europe. Hawkish central banks. Energy shortages. The list goes on and on.

It is more boring, however, to point out that stock markets — while certainly reflecting the mood of the day — ultimately reflect corporate earnings. Not only that, but corporations aren’t particularly levered, and the banking system is in solid shape. High yield default rate projections are in the 3-4% range, suggesting that the upcoming default cycle will be relatively mild.

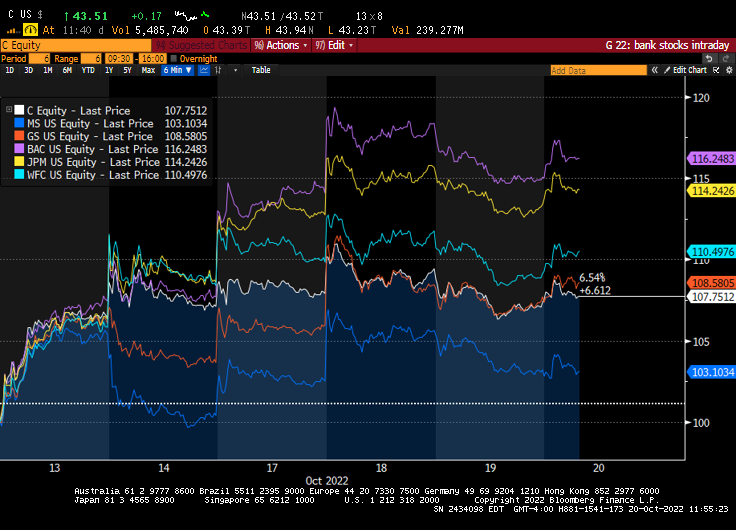

And with earnings season just under way, earnings have so far been pretty good. Case is point is what’s happened to banks since last Friday. All major banks are up handily in the last week, with Morgan Stanley the relative laggard.

The winners have been the large commercial/investment banks, like JP Morgan, Citigroup, Wells Fargo, and Bank of America. These large international banks have a unique window into the state of corporations and the consumer, and what they are reporting isn’t so bad.

According to a NY Times headline: “Bank of America’s Earnings Suggest U.S. Consumers Remain Strong and Active.” According to Wells Fargo: “Both consumer and business customers remain in a strong financial condition, and we continue to see historically low delinquencies and high payment rates across our portfolios.”

The unfortunate fact is that gloomy punditry may sell newspapers (or get web clicks), but it doesn’t help investors’ returns.