October 4, 2022 —

Overview

September of 2022 was not a pleasant month in financial markets. At the lows, 30-year gilts (U.K. government bonds) had fallen by roughly 33% relative to their August 31 close. That’s a big fall for stocks, but for highly-rated government bonds this is almost unheard of. In fact, things got so bad that the Bank of England had to step in and announce its intention to buy long-dated U.K. government bonds to support the gilt market (thankfully, as of the time of this writing, that intervention is working). Meanwhile, not to be outdone by its northern financial center rival, one of Switzerland’s major banks, Credit Suisse, saw its stock price decline by close to 25% in September, on the back of (self-fulfilling) speculation that the bank will need to raise additional capital. When the plumbing of the financial system starts to act up, policymakers and central banks sit up and take notice. And the Federal Reserve (Fed) is surely paying close attention to these emerging stress points in markets.

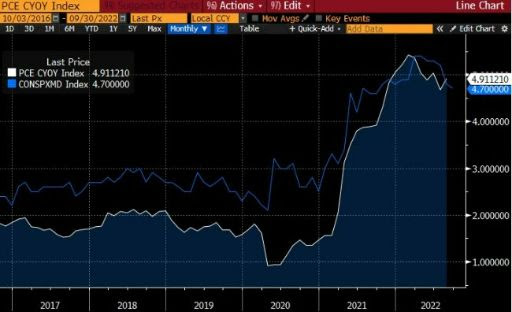

Source: Bloomberg

The story of how we got into this predicament starts with inflation. The above chart shows year-over-year changes in the Personal Consumption Expenditures Price Index, which is a measure of inflation that excludes food and energy prices, and gives a lower weight to housing relative to the core Consumer Price Index (CPI). PCE inflation, said to be the Fed’s preferred inflation measure, was comfortably sitting at or just under the Fed’s 2% target for several years, until it began to spike in 2021. That initial spike was — in retrospect, incorrectly — attributed to transient factors arising from the COVID-19 pandemic. But the spike persisted into 2022, exacerbated by increased food and energy prices due to the war in Ukraine. More worryingly from the Fed’s point of view, the spike in inflation was accompanied by an increase in people’s expectations of future inflation (the blue line in the above chart shows the next-year inflation expectation from the University of Michigan Consumer Survey) and the associated risk of higher inflation expectations becoming embedded in the consumer psyche.

Source: Bloomberg

To control inflation and inflation expectations, the Fed turned to its trusted playbook of raising rates to slow economic growth and of raising the temperature on its inflation-fighting rhetoric. In an example of the latter, Fed Chairman Jay Powell gave a much more hawkish-than-expected message to the global economics cognoscenti at the August Jackson Hole meeting. That message sent shivers through financial markets, which had been doing well prior to Powell’s speech (see above chart of the S&P 500 index). With the market ever more convinced of the Fed’s inflation-fighting intent, the September 13th slightly higher-than-expected CPI print fell on an already skittish market, and the rest, as they say, is history (see above chart again).

Source: Bloomberg

Thing is, inflation expectations appear to be quickly receding, as the above chart of 10-year breakevens shows (breakevens give the difference in yields between nominal Treasury and inflation-protected Treasury bonds). For good measure, the University of Michigan survey of investor year-ahead inflation expectations (the reddish line above) is sending the same message. Other anecdotal evidence — such as the sharp slowdown in housing markets, 30-year mortgage rates which briefly touched 7% in September (from a 2021 level of 3%), the sharp increase in the value of the U.S. dollar, and stories about Walmart and Target being unable to clear inventory from their shelves without discounting — is sending the same message. No doubt the Fed, and other central banks, are all too aware of these goings-on, as well as of the aforementioned U.K. and Credit Suisse debacles. Perhaps much of the tightening that central banks wanted to deliver has already been priced into markets. The recent 30 basis point drop in 10-year Treasury yields suggests this is indeed the case.

QuantStreet

That brings us to QuantStreet, and how we’ve been investing on your behalf. September was not a great month for us either, but as the table below shows, we managed to outperform our benchmark — the globally diversified MSCI All Country World Index (ACWI) — by roughly 1.4%, bringing our after-fee launch-to-date outperformance relative to the ACWI to just under 5.2%. Our September performance was helped by our exposure to investment grade corporate bonds and commodities, both of which, while down, handily outperformed relative to the ACWI.

Source: QuantStreet, Bloomberg. Our life-to-date (LTD) performance starts on 12/1/2021.

One of the major benefits of a systematic investment strategy — even when closely supervised by people, as in our case — is that the forecasting and asset allocation models don’t pay attention to the day-to-day din of financial markets and the news media. Instead they focus on historical empirical relationships between forecasting variables and future asset-class outcomes. Using these relationships, the models identify the portfolio with the highest expected returns at a chosen risk target, which for our core strategy is the last one-year realized volatility of the ACWI index (most recently running at 18%). This month, our dispassionate asset allocation framework reduced our prior exposure to momentum stocks and investment grade corporate bonds, added to our position in the S&P 500 index, and initiated a new position in the VXUS ETF, which tracks global stocks (Japan, U.K., China, Canada, etc.) but which excludes U.S. stocks (we of course already have a large U.S. equity exposure via the S&P 500). Global non-U.S. stocks have underperformed their U.S. counterparts so far this year, and the underperformance has become so large that our model now favors a small allocation to this asset class, based largely on valuation grounds.

Our risk target remains at the level of our ACWI benchmark, reflecting neither aggressive nor defensive overall risk positioning. We do not want to take on more risk than the benchmark at the moment because there are plenty of negatives and downside risks in the global economy and markets, nor do we want to be defensive because much of this negativity is already reflected in market prices.