April 6, 2023 —

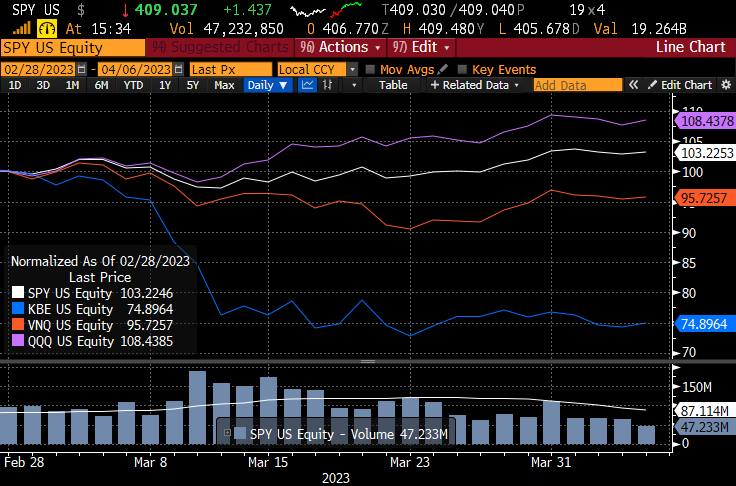

March 2023 represented a drastic change in the narrative that had prevailed in markets for most of 2022 and early-2023. The precipitating event was the failure of Silicon Valley Bank (SVB) when it was seized by the regulators on Friday, March 10, 2023. The SVB event led to a large sell-off in other bank stocks, as well as a re-evaluation of several investing themes.

Bank depositors realized that not all of their deposits were riskless. They started to pull money from banks — especially regional banks — to move it into either money market funds or into short-dated Treasuries. The need to compete with these alternatives for funding will put banks’ earnings under pressure for some time, and will also constrain bank credit provision to the economy. With less credit provision, it is likely that economic growth will slow, especially in parts of the economy that are very credit reliant, like high-yield firms or those exposed to commercial real estate. Slower economic growth, in turn, will lead to lower commodity prices, lower inflation and interest rates, and higher bond prices. Indeed, many of these themes have already started to manifest themselves in financial markets.

We have written more extensively about this market transition on our Substack site (please subscribe if you are not a already subscriber).

QuantStreet Positioning

Despite the mini-banking crisis that began in March of 2023, the month — surprisingly — proved to be a good one for financial markets and for QuantStreet. We entered March after having reallocated a larger portion of our portfolio to quality U.S. and international bonds. This served us well because bonds had a very strong month in March. What detracted from our performance was our exposure to value stocks (through the VTV exchange traded fund with its heavy bank and energy exposure), to REITs (through the VNQ ETF), and to commodities (via the GSG ETF).

Based on our analysis of the historical risk-reward tradeoffs among our investable ETFs (we’ll write more about this soon) and our forecasting model output, we have repositioned our portfolio to reflect the following themes:

- Banks stocks and firms exposed to bank funding are likely to be under pressure. This argues against VTV and VNQ exposures.

- The credit shock coming from the mini-banking crisis is likely to slow economic growth, which argues against commodity exposure.

- Growth companies with solid balance sheets will benefit disproportionally because (1) they don’t need funding and (2) because their long-dated cash flows are less cyclical and are not particularly sensitive to falling interest rates.

- High quality fixed income securities remain attractive because interest rates remain relatively high relative to falling growth and inflation expectations.

For multiple reasons that we’ve discussed in the past, our view is that the SVB-initiated shock will not turn into a systemic bank crisis. This view has been reinforced by the robust regulatory response that this mini-crisis has engendered. For this reason, our portfolio is not defensively positioned, but we have repositioned our sector exposures to reflect the transitioning economic narrative that began to emerge in March.

To learn more about the performance of our strategies, please contact us.