November 3, 2023 —

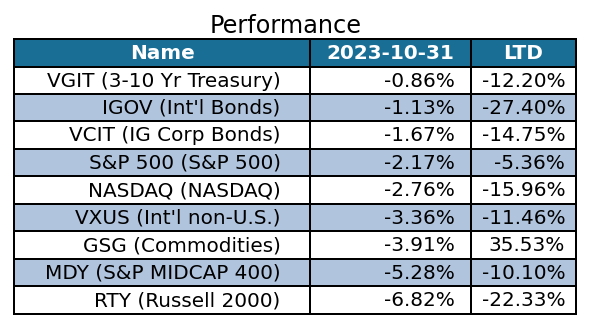

October 2023 was a weak month for financial markets, with bonds, stocks, and commodities all down. Though interest rates continued to increase in October, bonds (U.S. and international government bonds and U.S. corporates) were the best performing asset class. U.S. broad market indexes, like the S&P 500 and Nasdaq, were down in the 2% range, while international stocks were down over 3%, as were commodities. Finally, small- and midcap U.S. stocks were the worst performers, down over 5%.

QuantStreet’s performance in October was also negative, though across our three portfolio strategies (aggressive, core, and balanced), we generally outperformed our benchmarks. You can see our October performance, as well as historical performance of our strategies and benchmarks, here.

Research

In October, we published two pieces in Advisor Perspectives. In the first, we argue that the higher-rates narrative prevalent in hedge fund circles is likely incorrect, and that rates are more likely to head down rather than up. The first few trading days in November of 2023 have started to bear out this thesis. In the second piece, we recapped performance of the major asset classes in 2023, and discussed our thoughts for what the next 12 months may look like. Our general view is that, selectively, stocks continue to look attractive and that rates are likely done going up for the foreseeable future.

In a new Substack post we argue that U.S. Treasury rates are 100 basis points too high relative to QuantStreet’s international interest rate valuation model. Combining this with potential macroeconomic risks from Fed tightening and geopolitical risks stemming from Hamas’s October 7th terror attack against Israel and the subsequent war, we argue that low-coupon, long-dated government bonds may serve as an effective hedge against future unknowns.

If you would like us to implement this low-coupon, long-dated U.S. Treasury trade for you in a separately managed account, please reach out.

Looking ahead

Our portfolio is positioned for the month ahead in line with our model’s reward-risk assessments, and our subjective views about potential risks lurking on the investment landscape. In November, we reduced our commodities exposure and added a position in long-dated U.S. Treasury bonds. Overall, we remain sanguine on markets in the coming months, though we acknowledge macroeconomic and geopolitical risks abound.

Please reach out to us at hello@quantstreetcapital.com with any questions.

(The featured image is thanks to Jari Hytönen on unsplash.com).