February 1, 2026 –

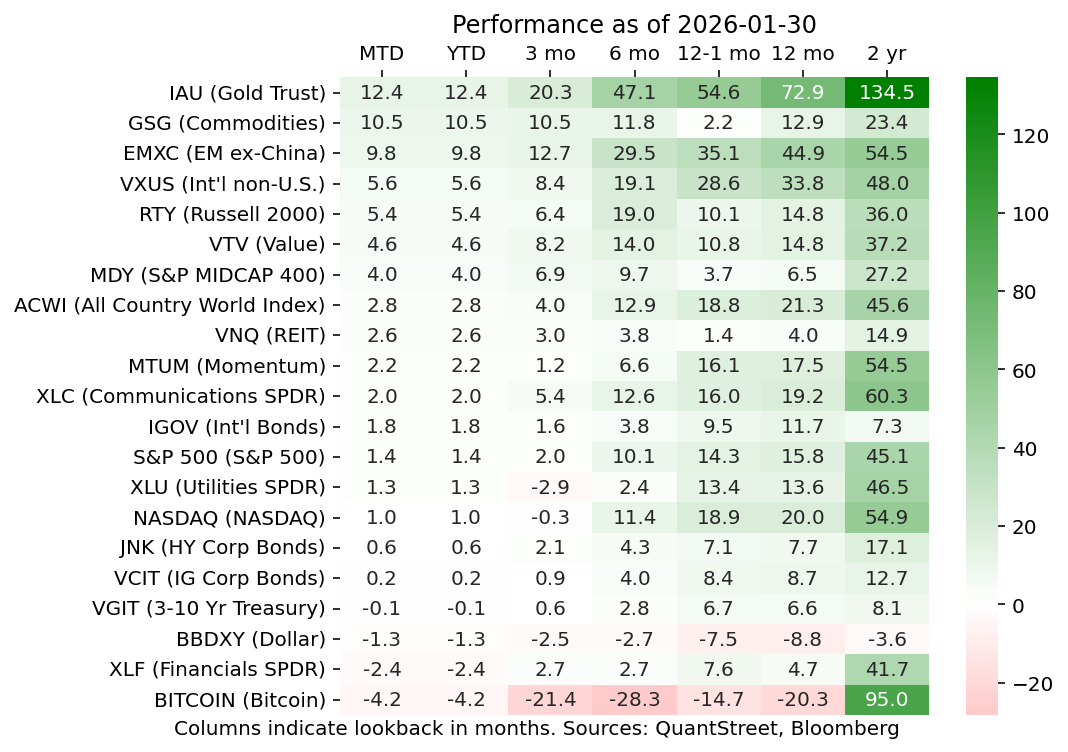

Our recent piece on the dollar neatly lays out much of what drove price action in January of 2026. Despite a disastrous last trading day in the month, gold carried its 2025 rally into 2026, and finished the month up over 12%. The dollar finished the month down 1.3% for a litany of reasons, including our progressively nastier spat with Canada and the Trump administration’s insistence on liberating Greenland. Though cooler heads have prevailed with regard to the latter (at least for the time being), each episode of the usual DJT news cycle–President Trump making extreme claims, followed by everyone else freaking out, followed by his backing down and ultimately coming to a reasonable resolution–leaves the dollar a little bit weaker than it was before.

This is all well-summarized in a recent Financial Times article which argues that:

“The Greenland crisis has reignited concerns about the political risks of US assets — for a long time a safe harbour for global capital — that helped drive a 9 per cent decline in the US dollar last year in its steepest drop since 2017.”

We agree. Our guess is that this will continue for the remainder of President Trump’s second term, and whoever occupies the White House next will have a heck of a time restoring global trust in the dollar as an unquestioned store of value. Our second guess is the gold narrative as a refuge from all of this will also continue to build, alongside continued gold appreciation (Friday’s ugly price action notwithstanding).

Looking across other asset classes, international led the way with small-caps (RTY) and midcaps (MDY) also catching a bid. Financials were weak on the back of the Trump administration’s threat to cap credit card interest rates at 10%. The banking industry was less than excited about the proposal, and with some justification, argued that price caps on credit provision would restrict access to credit by making loans available only to the most creditworthy borrowers and pushing others into more costly credit instruments. Bitcoin continued is descent to earth–sub 80,000 at the time of this writing–and appears to have been overtaken (for the moment) by gold as the asset of choice for those not fond of the greenback.

Our pivot towards more international exposure at the start of January proved well timed, though as we mentioned last month, we still maintained a slight US overweight relative to target-date fund allocations. Given last month’s price action, we wish we had gone all in on international, but no one has a crystal ball. As of this month, the US overweight disappears, and for the first time in our history as a firm, we are overweight international assets relative to benchmarks. This is not because we are bearish on US stocks–we are definitely not–but the dollar headwind will be a lot to overcome. You can see details about our performance here.

As an aside, we will write more about where these “benchmarks” come from soon on our Substack (please sign up if you haven’t already). For those who don’t want to wait, but need to know right now how one can use target-date funds to extract the “wisdom of Wall Street,” send us a note we’ll share our white paper. It is not for the faint of heart.

Update on QuantStreet

We just filed our Form ADV for 2026. If you want to learn more about our firm, this is the place to go (and also check out our firm brochure available from the same website). One notable development is that we also filed for SEC registration. Prior to this we were registered with the State of New York, but given our growth in 2025 (and 2026), we hit the assets under management threshold for SEC registration. This will be a largely transparent move for our clients, but represents another step in our journey as a firm.

We brought on new financial planning software, called RightCapital, and are starting to onboard clients on it. Though we like our own Monte Carlo simulation engine more, RightCapital gives us data sharing and visualization capabilities which we did not previously have. It also provides a user-friendly client-facing portal which allows us to better communicate financial plans. We also recently added customer relationship management software, called Redtail, for the simple reason that we outgrew our spreadsheet-based record keeping system.

If you want to learn more about us or chat about how we can help you with your wealth management and financial planning needs, please reach out (see below).

And finally

For those still questioning the ascendancy of AI, here is a picture (the first one) Nano Banana (Google’s AI image engine) generated after a minute of refinements by yours truly. Next to it is the same image (the second one) a predecessor Gemini model generated one year ago. I can only describe the capabilities of the new system as stunning, even compared to the already incredible image generation capability Gemini had one year ago. (By the way, the new image was not meant to be hyper-realistic, though it can do that too, but the ask was to maintain the same cartoonish quality as the original.)

If this is representative of what’s happening in other parts of the AI space–and it is–we’re in for a heck of a show in 2026.

Working with QuantStreet

QuantStreet is a registered investment advisor. It offers wealth planning, separately managed accounts, model portfolios and portfolio analytics, as well as financial consulting services. The firm’s approach is systematic, data-driven, and shaped by years of investing experience. To work with or learn more about QuantStreet, join our mailing list or contact us at hello@quantstreetcapital.com.

Please keep in mind that all financial forecasts are fraught with risk and uncertainty. Our views may prove incorrect and market outcomes may be materially worse than we anticipate. Please see our full disclosure about the limitations of forward looking statements and the risks of investing at https://quantstreetcapital.com/terms-of-use/.