September 2, 2022 —

Dueling Narratives

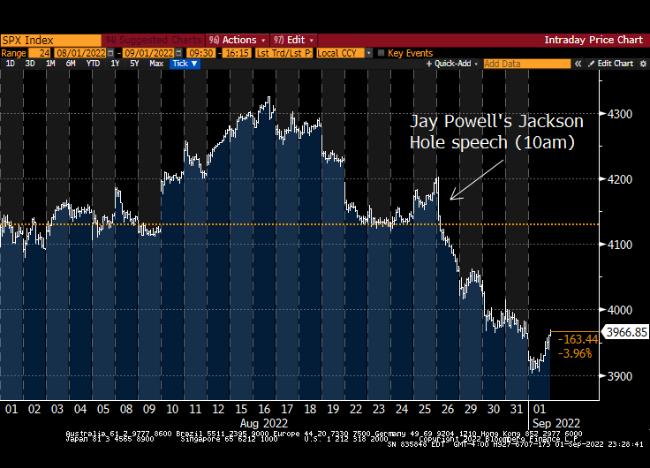

August was moving swimmingly along, set to extend the July rally, when Chair Jay Powell of the Federal Reserve stepped up to the microphone in Jackson Hole, Wyoming to give a speech at the August annual meeting of central bankers and economists.

The market was coming around to the thesis that the hard work needed to be done by central banks was a bit in the rear view mirror, with commodity prices slightly lower and inflation expectations off their earlier-in-the-year highs. But Powell’s speech set a much more hawkish tone than expected, and his warning that “[r]estoring price stability will likely require maintaining a restrictive policy stance for some time” caught market participants off guard.

But no one ever accused investors of not paying attention when the chair of the Federal Reserve speaks, and markets, S&P 500 included (see chart), promptly sold off in unison, with stocks, bonds, and commodities all experiencing steep declines. It is often difficult to establish definitively causal influences for market movements, but in this case (as the S&P 500 chart shows) it is clear that the Powell speech was the precipitating event for the selloff.

How has QuantStreet performed? Beginning with the big picture: Since the time of our launch, we have outperformed both our benchmark, the MSCI All Country World Index (ACWI), and the S&P 500. Our launch-to-date outperformance relative to the ACWI stands at close to +4.5% while our outperformance relative to the S&P 500 stands at +2.5%.

Despite outperforming our benchmark, we do not run a market neutral strategy and thus did not avoid the overall market pain in August. We finished the month down just over 4% (compared to 3.6% for ACWI). The worst-performing part of our portfolio was our REIT ETF (VNQ), which finished the month down 6%. Commodities, though down close to 3%, represented the best-performing part of QuantStreet’s portfolio in August. What was remarkable about August was the uniformity of the selloff. Seemingly no asset class was spared.

The table below summarizes our performance and that of related asset classes in August 2022, and since our launch in December of 2021.

The first column shows performance in August of 2022. The LTD column shows the performance since QuantStreet’s launch in December of 2021.

Performance note: QuantStreet does not run a market neutral strategy. Our strategy follows the markets. When markets are up, we’ll generally be up; when markets are down, we’ll generally be down. Since our launch in December of 2021, ACWI is down 14.13% while QuantStreet is down 9.85%. We have on average been down less in months when the ACWI has been down and up more in months when the ACWI has been up.

Exploring the Dueling Narratives

To understand what caused the near-universal selloff in risk assets in August, we delve into the narrative that prevailed at the Jackson Hole meeting, which no doubt, through extensive media coverage, seeped into investor beliefs as well. A nice summary of the prevailing views among analysts can be found in the Financial Times article entitled Global Economy Faces Greatest Challenge in Decades, Policymakers Warn.[1] The narrative goes like this:

- Inflation is high because of: (1) high consumer demand following fiscal and monetary COVID-related stimulus; (2) COVID-induced supply chain disruptions; (3) food and energy shocks due to Russia’s invasion of Ukraine.

- Central banks were slow to respond to building inflationary pressures (as a little thought experiment, imagine the public outcry if the Fed had started hiking rates in early 2021).

- The Fed and other central banks are being forced to act now by steeply raising rates, which will slow the economy, but which only indirectly addresses supply issues (i.e., high fuel and food prices), and the degree of needed tightening will push the world economy into a recession.

- Deeper and longer-term structural concerns are that (1) globalization and (2) access to cheap labor will become headwinds rather than tailwinds for the global economy.

You are excused if you now feel a little depressed.

Coincidentally, on the same day as the above-mentioned Financial Times article, the Wall Street Journal carried a piece with the disconcerting headline: Inventory Pileup, Uneasy Shoppers Put Retailers in Jeopardy.[2] Certainly not a particularly happy headline, but if you read on, you will learn that America’s preeminent retailers, Walmart and Target, are having a hard time clearing shelves to make room for the holiday selling season. Their solution: price discounts.

But wait, how can the world be on the precipice of an uncontrollable inflationary spiral when Walmart and Target can’t sell their inventory at the stated prices because consumers don’t want to buy it? While we may have to wait until the 2023 Jackson Hole meeting to learn the definitive answer to that one, perhaps a reasonable hypothesis is that the large amount of tightening that’s already in the system is doing its job, inflation expectations are already moderating (if you think there will be inflation, you certainly won’t wait to buy tomorrow a good you can buy today), and the world isn’t quite as close to inflationary Armageddon as the folks at Jackson Hole seem to think.

QuantStreet’s Portfolio

Where does this leave your portfolio? Fortunately, our quantitative allocation approach sees through much of the media din, and tries to distill from actual empirical evidence the drivers of expected return outcomes. Our models continue to like our investment grade bond and commodities exposures, but call for a complete reduction in our REIT and a partial reduction in our S&P 500 positions, and ask for a new position in momentum stocks, achieved via investing in the MTUM ETF.

We continue to target the risk level of our ACWI benchmark. That the models called for us to replace our REITs and a portion of our S&P 500 positions with a new position in MTUM is good news from a tax perspective because we have now realized some losses, which can be used to offset future capital gains.

Why does the current portfolio make sense? Our machine learning valuation models like both the S&P 500 and investment grade bonds, based on the current values of the best set of return forecasters for these asset classes. An exposure to momentum stocks now looks attractive based on a combination of our trend signal and the voluminous academic literature that has shown the presence of momentum effects across virtually all global markets.[3]

Commodities enter based purely on the trend portion of our signals, as commodities have been far and away the best performing global asset class over the prior year. Furthermore, many of the arguments made in Jackson Hole are valid (if perhaps slightly exaggerated), and having a commodity exposure serves as a hedge against exacerbation of some of these trends.

To see how everything fits together, below we show the correlation matrix of returns of the S&P 500, momentum stocks, investment grade bonds, and commodities, measured over the prior year. A correlation close to one means that two asset classes tend to move up and down together most of the time (like S&P 500 and momentum stocks). A correlation close to zero means that, on a day-to-day basis, there is no tendency for two asset classes to comove (like commodities and the S&P 500 index). And a negative correlation means that the risks of two asset classes offset each other, with one being up, on average, when the other one is down (like commodities and investment grade bonds).

From a portfolio diversification point of view, having uncorrelated assets (zero correlation) is great, and having negatively correlated assets is even better. Our portfolio allocation model, of course, is all too aware of this, and its current selection of asset classes reflects a combination of return forecasts and correlation structure that yields the highest expected returns at our targeted risk level.

Past-year correlations of returns of the S&P 500 (SPX), momentum stocks (USMOM), investment grade bonds (USIG), and commodities (COMDTY).

Footnotes

[3] See Value and Momentum Everywhere, Journal of Finance, https://pages.stern.nyu.edu/~