October 2, 2024 —

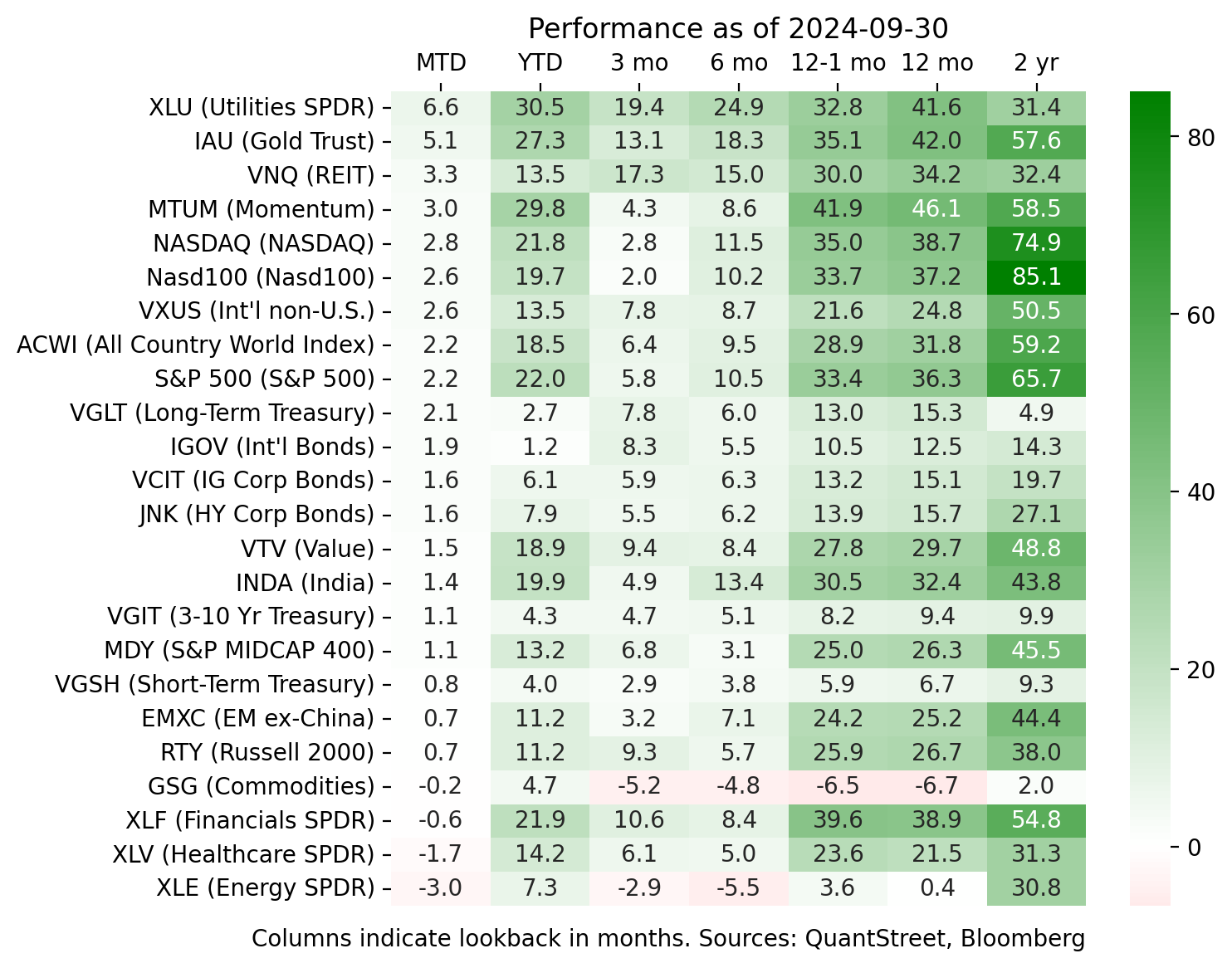

The major market event in September was the Fed’s 50 basis point rate cut following the September 18th Federal Open Market Committee meeting. There was broad consensus the Fed would cut rates, though the 50 basis points (as opposed to 25) and perhaps the tone of Jay Powell’s press conference surprised to the upside, at least based on the price action of September 19th.

Many market segments did well, especially utilities (which we discuss below) and gold (which has historically done well during Fed easing cycles, as we’ve written in the past). International ex-U.S. stocks (VXUS) also had a good month, largely on the back of a large stimulus policy in China (more below). The month’s laggards were financials, healthcare, and, most notably, energy stocks.

QuantStreet’s portfolios moved in line with benchmark asset allocation mutual funds. Our year-to-date performance remains strong relative to the benchmarks. More details about our performance are available here.

A few sector themes

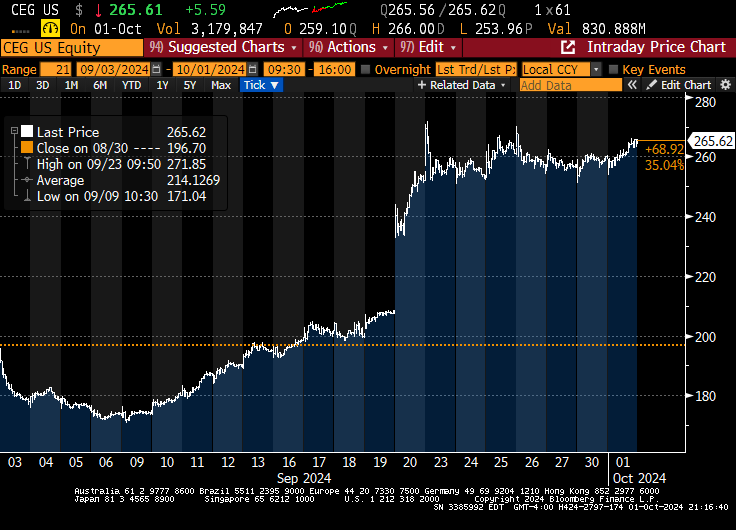

There was an extraordinary development regarding the utilities and AI theme we’ve been discussing for the last several months. According to a Wall Street Journal article, Microsoft and Constellation Energy (CEG) signed a 20-year deal to restart one of the nuclear reactors at Three Mile Island, with the electricity generated by this plant to be used exclusively to power Microsoft data centers. As might be expected, CEG’s stock price reacted favorably. Our view is this is one of many future such deals, which will provide a tailwind to our utility overweight (which is in the portfolio due to our systematic allocation process, but a catalyst does not hurt).

Another extraordinary development in September was the fiscal stimulus proposed by Chinese authorities. The Wall Street Journal summarized the stimulus as follows:

- “Freeing up some $142 billion for new lending, by cutting banks’ reserve requirements. A second such cut could come later in the year.”

- “Lowering a key short-term interest rate, the 7-day reverse repo, and reducing one-year borrowing costs.”

- “Making loans to shore up the stock market, including about $71 billion to help market players buy shares, and nearly $43 billion to fund corporate share buybacks.”

- “Offering relief for homebuyers, with lower rates on existing mortgages and lower minimum deposits on second homes.”

On the back of such news, the Chinese stock market (as proxied by the FXI ETF) rallied 25% last month, lifting international stocks alongside.

Our view is the problems in China are more structural in nature (e.g., take a look at the Bloomberg News article titled “Xi Unleashes a Crisis for Millions of China’s Best-Paid Workers”). The stimulus feels more like a band-aid solution than a permanent fix. Something similar happened when the SEC banned short selling of financial stocks on September 19, 2008 . Financial stocks rallied for one day, only to continue their selloff for the rest of the year (see next chart). Our guess is that Chinese stocks do something similar, though some are saying Chinese assets are poised to do extremely well. Time will tell.

After being a market laggard for several years, CVS has finally garnered activist investor attention, as hedge fund Glenview Capital acquired a 1% stake in the company and is now pushing for changes in corporate strategy. As the next chart shows, the stock reacted very positively, which perhaps sends a good signal for the rest of the healthcare space, which, like CVS, has an impressive portfolio of assets but poor relative market performance over the last few years.

A word on advisor fees

When you work with a financial advisor, you pay two sets of fees. The first fee gets paid to your advisor. The second fee gets paid to the sponsors of the investment products that your advisor puts in your account. When advisors are affiliated with large asset managers, there is incentive to put accounts into high fee investment vehicles — like some mutual funds or hedge funds — run by the parent asset management firm. At QuantStreet, we are independent of any large financial institution. (We custody at Schwab but receive no fees or other compensation from Schwab for using their products.) Our only incentive is to find low cost, liquid ETFs which make sense for our clients.

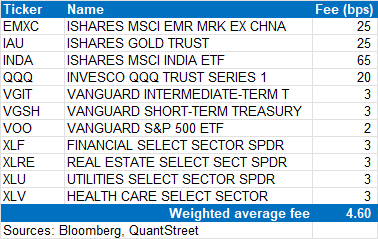

For example, the following table lists the ETFs we currently have in our tactical model portfolios, as well as the annual management fee (in basis points) associated with each ETF, as reported by Bloomberg. Our highest cost ETF, INDA, tracks the Indian stock market, and we do not have a lower-cost, liquid alternative to provide that exposure (the FLIN India ETF is lower fee, but much less liquid). However, the INDA ETF represents only around 1% of the overall portfolio. Many of our largest ETF positions are in products, like the S&P 500 ETF VOO, which have annual management fees in the 2-3 basis point range (a basis point is 1/100th of a percent). The weighted average fee our investors pay in their ETF portfolio is 4.6 basis points, or 0.046%, per year (this is for the 85/15 strategy, though it is similar for our other strategies). For our clients, their all-in cost is thus our fee plus 4.6 basis points.

For clients of advisors who are incentivized to invest in high-cost investment products run by their parent firms, additional management fee expenses can be much higher than 4.6 basis points. If you are not sure what the outside management fees look like in your portfolio, ask your advisor. If you’d like to find out how to potentially cut those fees by investing in low-cost, liquid ETFs (like we do), please reach out. We’d love to hear from you.

Working with QuantStreet

QuantStreet is a registered investment advisor. We offer wealth planning, separately managed accounts, model portfolios and portfolio analytics, as well as consulting services to our clients. Our approach is systematic and data-driven, but also shaped by years of investing experience. If you are an existing client or if you are thinking about working with us, we’d love to hear from you. Please reach out to us at hello@quantstreetcapital.com.

Cover picture generated by Gemini.