February 4, 2024 —

Markets continued their strong performance in January of 2024, though it was hard to live up to the incredible returns of November and December of 2023. However, as the next table shows, the strong aggregate performance in January hid much variability when looking at individual markets.

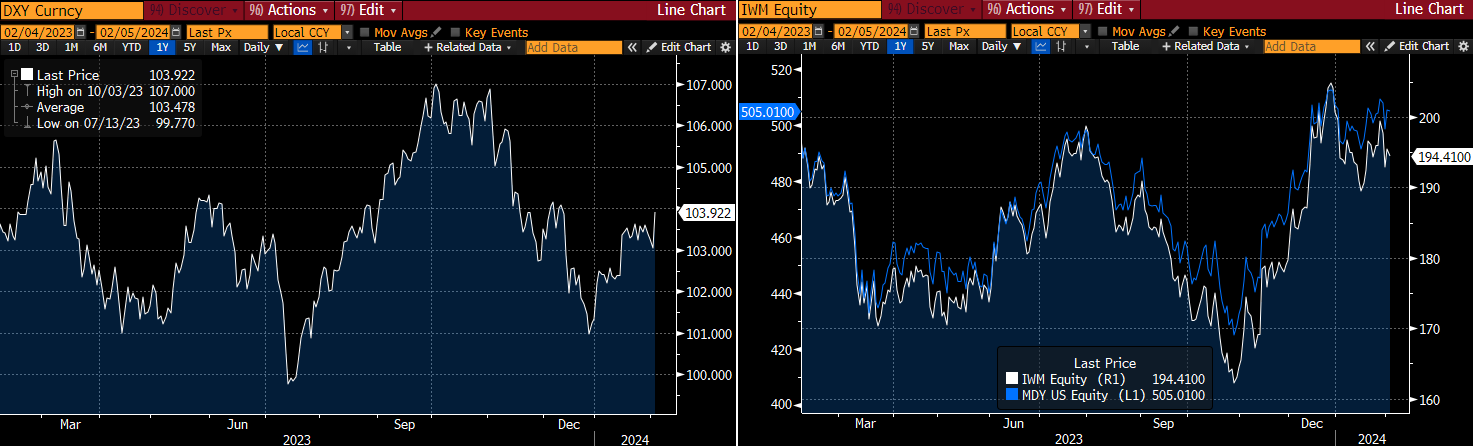

One theme for the month was a sharp rally in the U.S. dollar (DXY), offsetting some of the dollar selloff that begin in late-October of 2023. With the rally in the dollar, international ETFs fared poorly, as can be seen in the performance of VXUS (global non-U.S. stocks), EMXC (emerging markets ex-China), and IGOV (non-U.S. sovereign bonds).

Another theme was a selloff in small- (IWM) and midcap (MDY) stocks which had large rallies at the end of 2023. Some other underperforming sectors, like healthcare (more on that below) and financials, had a strong month in January.

Given our underweights to international assets and small- and midcap stocks, QuantStreet’s portfolios had a good month, in absolute terms and relative to our benchmarks. (For more on our views about international diversification, please see this research piece.) To remind readers, we run several different risk-level portfolios which we benchmark against asset allocation mutual funds with a mandate to invest in international and U.S. stocks and bonds, and which run at comparable risk levels to our strategies. The benchmarks are run by the large asset managers, like Vanguard, BlackRock, Fidelity, and so on. You can read a detailed analysis of our life-to-date performance, in absolute and relative terms, on the performance page of our website.

Research

Following the sharp late-2023 rally in small-caps, midcaps, and value stocks, we spent a bit of time thinking through whether the almost two-decade-long value underperformance is likely to reverse, or begin to reverse, in 2024. Three main takeaways of our analysis (which you can read here) are that: (1) the valuation differential between value and growth has not been a good forecaster of value outperformance in our sample period; (2) value and growth industries rarely change over time; and (3) there is little reason to believe that, at least in the industry level, “cheap” industries are cheap because investors aren’t paying attention (i.e., they are “cheap” for other reasons, like slower growth).

On a related point, given the very strong performance of all things related to technology in 2023, we also analyzed the historical evidence on what happens to industries in the year after a boom (like the 2023 technology boom). Our conclusion (which you can read here) was that past industry-level booms forecast high future volatility, high average future returns, but low future Sharpe ratios. However, it is definitively not the case that all past booms are followed by busts. Some are, but most aren’t. This study contributes to our relatively sanguine view of the technology sector.

Given these two studies and our firm’s forecasting analytics, the main conclusion for investors is that value does not currently look attractive but growth does.

Portfolio updates

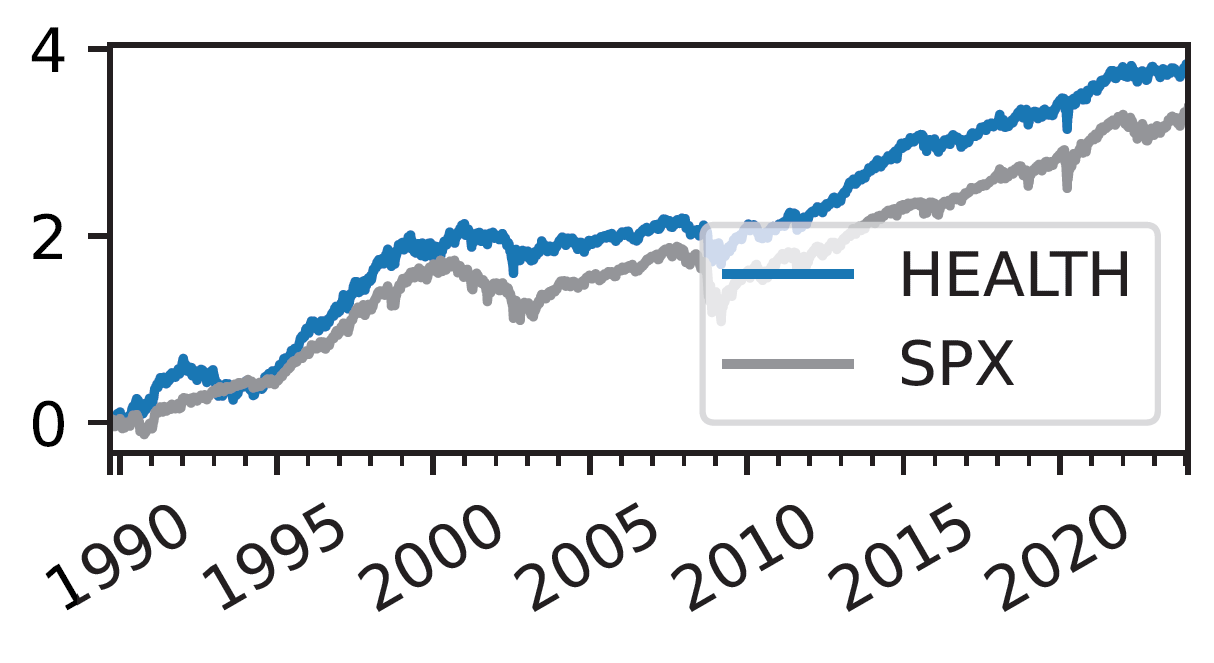

For the month ahead, we reduce our international exposures, across developed and emerging markets, due to relatively weak model return forecasts and weak trend signals for these asset classes (January 2023, which fell out of our one-year trend measure was a very strong month for VXUS and EMXC). We add an exposure to healthcare, a first for our tactical portfolios. We wrote recently that the healthcare sector has had attractive historical fundamental and return performance (the chart below shows the cumulative return of healthcare stocks versus the S&P 500 since 1990). More importantly we argued that forward-looking fundamentals for healthcare are very attractive based on demographic projections and technological innovation.

The one overhang that kept us out of the sector was a difficult regulatory environment, especially in light of the Medicare drug pricing parts of the Inflation Reduction Act. There are multiple lawsuits making their way through the court system arguing against the legality of this legislation. It is hard to handicap what the market is pricing in with regard to the outcome of these lawsuits, but adverse outcomes for the industry would certainly be bad for healthcare stock prices, so this remains a risk. In addition, there were multiple earnings headwinds in 2024 — such as inflation, high interest rates, and a COVID-19 overhang — which are all starting to lift. Recent research pieces (here and here) are relatively bullish on the sector. QuantStreet’s valuation model is extremely bullish on the sector, and the last-year return trend is looking better post the sector’s strong performance since late October 2023. Together with the sector’s low correlation with other parts of the stock market, these considerations make healthcare stocks an attractive addition to our portfolios.

Working with QuantStreet

QuantStreet offers wealth planning, separately managed accounts, model portfolios, and consulting services to our clients. If you are an existing client or if you are thinking about working with us, we’d love to hear from you. Please reach out to us at hello@quantstreetcapital.com.

(The featured image is from Wikipedia).