December 3, 2024 —

We launched QuantStreet a little over three years ago, and our first accounts went live as of December 2021. In this piece, we take a bit of a look back, and discuss lessons learned and how our business has evolved. But first, a quick peak at the market action of this past November.

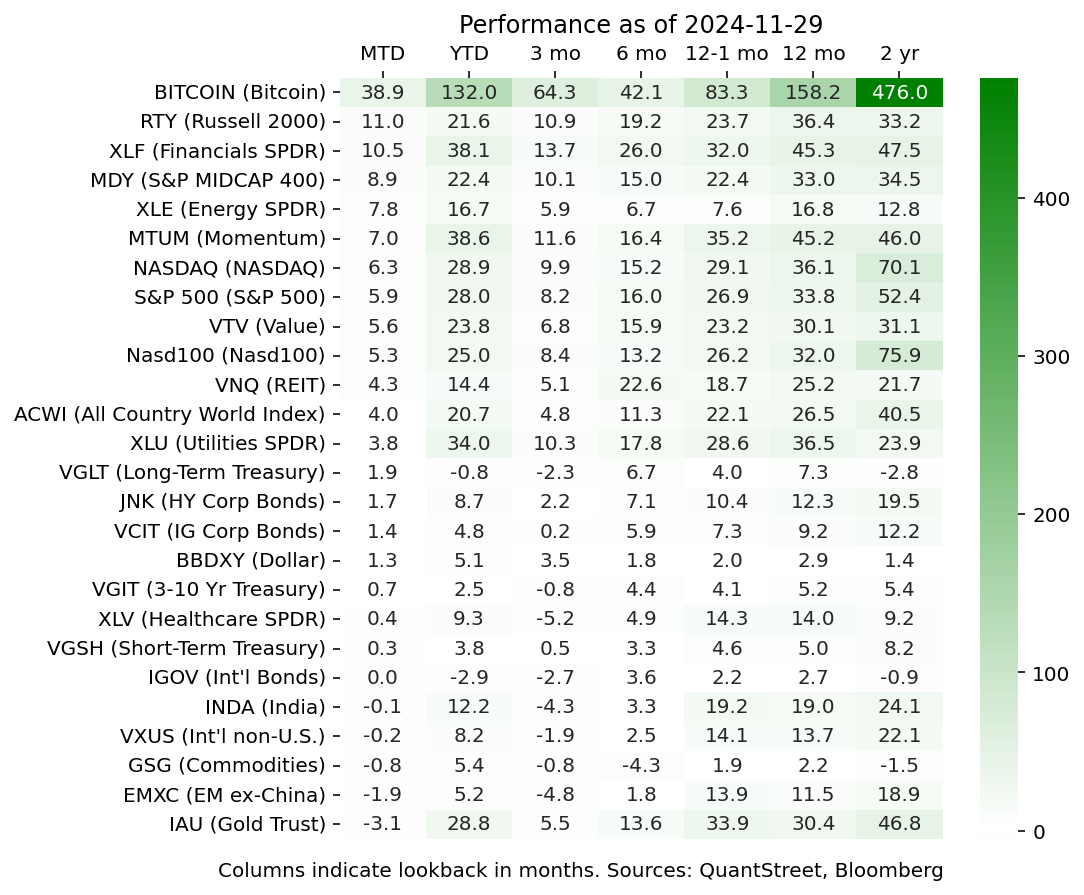

Trump Rally

November saw Trump win his second Presidential election, though it was much less of a surprise this time around. Nevertheless, Trump trades were pervasive in November once the election outcome became clear. First, there was bitcoin, up nearly 40% in the month on the back of a clearly more crypto-friendly administration, with its very own DOGE department (of course, dogecoin had a stellar November as well). Trump’s tariff plan and American-focused business agenda propelled small- and midcap stocks to a stellar month as well. Then, there were his appointments of Chris Wright as energy secretary and Doug Burgum as Secretary of the Interior. Both were perceived as highly supportive of America’s fossil fuel industry. Energy stocks were clear winners in November. Finally, financials had a great month, as Trump’s deregulatory agenda was perceived by investors as being highly supportive of a resurgent M&A cycle. Also helping lift the mood in financials was a steepening yield curve and the anticipated continuation of a Fed easing cycle.

Not everything was rosy however. Trump’s appointment of RFK Jr. to head the Department of Health and Human Services was perceived negatively, and the uncertainty this introduces in our national healthcare policy contributed to a continuation of the year-to-date underperformance of healthcare stocks. All things international underperformed, while the dollar rallied strongly in November. Gold slumped, perhaps because the market believes that Trump will make good, at least partially, on campaign promises to end the wars in Ukraine and the Middle East. Anecdotally, a large part of the gold rally has been due to central bank buying, a dynamic that might be less prevalent in a more geopolitically stable world.

Our view is that many of these dynamics — a positive banking backdrop, strong support for the fossil fuel industry, and regulatory headwinds for healthcare — will persist well into the Trump presidency. We remain sanguine on gold because, while we certainly hope that Trump’s election does usher in a period of geopolitical stability, many risks remain and gold remains a time-tested hedge for uncertainty. Our analytically driven portfolio allocation process does not currently favor small- or midcap stocks, so we do not have exposure in those parts of the market.

Performance

QuantStreet’s investment approach uses modern data analytics and financial economics to construct efficient portfolios at client-specified risk levels. [1] Our investable universe includes U.S. and international stocks and bonds, and a few alternatives, like gold and commodities. All of our investments are done through liquid, low cost (whenever possible) ETFs. Natural benchmarks for our strategies are asset allocation mutual funds with a similar asset allocation mandate.

Since launch, our analytically-driven portfolio process has been overweight the U.S. and growth stocks, and underweight international, value, and small-caps. Adding in a few well-timed (and some not-so-well-timed) tactical calls, our performance has been strong. It was especially strong in November as U.S. assets meaningfully outperformed their international peers. You can see details about our performance over different time periods here.

The next table summarizes the performance of the three risk levels we’ve run as separately managed accounts for our clients. The end of November marks the three year anniversary of the 85/15 strategy, i.e., the same risk level as an 85% U.S. stock and 15% intermediate duration Treasury bond portfolio. Our performance has been strong, as we’ve outperformed our benchmarks — all of which are run by major asset managers — in all three risk buckets. [2]

| 60/40 | 85/15 | 95/5 | |

| Launch date | 2023-08-16 | 2021-12-01 | 2022-11-17 |

| Post-fee return | 23.99% | 30.06% | 49.46% |

| Competitor outcomes | 15.82%-19.49% | 16.16%-18.73% | 39.50%-42.93% |

Model Portfolios and Independence

When we first started the business, we felt that our independence would be a key advantage for us relative to competitor wealth advisory firms. Since we are not affiliated with any external asset managers, we have no incentive to invest in any particular asset manager’s funds. Our only incentive is to invest in low cost and liquid ETFs that make sense for our clients (and for our own investments with QuantStreet). [3] Our tactical portfolios this month have underlying ETF management fees that range from 3.6 to 4.6 basis points (a basis point is 1/100 of a percent), while our strategic portfolios have underlying fees ranging from 4.5 to 8.1 basis points. [4]

Our portfolio analytics clients, who receive monthly risk-targeted tactical and strategic portfolios, pay us a fee for this service. While they have access to “free” model portfolios offered by the large asset management firms, such “free” portfolios typically invest in funds provided by their parent institutions. And investing in those funds is not free. We recently compared the underlying fund or ETF management fees in our 85/15 tactical portfolio against those of three “free” portfolios which operate at similar risk levels. [5]

| Model portfolio | Value-weighted fee (basis points) |

| QuantStreet 85/15 | 4.4 |

| Manager A | 22.3 |

| Manager B | 22.8 |

| Manager C | 50.5 |

It turns out that “free” portfolios aren’t really free. If our clients paid us even 15 basis points for our model portfolios — and they pay much less than this — our portfolios would still be cheaper than the “free” alternatives that are on offer. Of course, our model portfolio subscribers also receive our forecasting and risk analytics. Our analytics elevate the level of conversation advisors have with their own clients, and ultimately contribute to better client retention and acquisition.

Our Wealth Management Clients

In addition to our portfolio analytics offering, we provide wealth management and financial planning services to our retail clients. We are happy to report that this part of our business is also growing. The world of investing is complex, with perpetual market and macroeconomic cross currents, and a proliferation of complex financial products that many individual investors are not in a position to evaluate. Our individual investor clients find value in our analytical approach to markets and financial planning. We help our clients make prudent investing decisions while simplifying their portfolio composition and avoiding common pitfalls, such as:

- High cost products. We’ve seen many funds that charge considerably higher fees than those offered by the best-in-class providers. We are independent of any external asset managers, and our objective is to find low cost, liquid investment vehicles for our clients. We’ve also come across high cost, option-based ETFs, which offer strategies that we can implement in a more cost efficient way directly in clients’ portfolios, though such bespoke solutions are subject to minimum investment thresholds.

- Complex and illiquid investments. Often financial products have gates which don’t allow investors to quickly redeem their investments. Other products engage in dynamic trading strategies, like tax-loss harvesting, that are costly and have tracking error, but are not a good fit for some clients’ specific needs. While we recognize that complex investing solutions are appropriate for some, we try to keep things simple whenever possible.

- Portfolios that are poorly tailored to customer needs. Ultimately the goal of a financial advisor is to understand their clients’ needs and objectives, and to tailor investment solutions to those needs. A crucial part of this process is listening to what clients actually want. Clients who do not like seeing large idiosyncratic fluctuations in their portfolios should not have large positions in individual stocks. Clients should not be stuck with portfolios that are either too aggressive or too conservative given their risk preferences.

Our overarching goal is to listen to clients, to offer them prudent advice, and to construct portfolios that are suitable for their specific circumstances. We also help clients with complex analytical tasks, like building risk models that incorporate their liquid and illiquid assets into a unified framework, or thinking through their decisions of whether or not to exercise recently vested stock options.

Overall, it’s extremely gratifying to work with our individual investor clients, helping them make more informed financial decisions and building robust investment portfolios tailored to their specific needs. It’s been a great first three years, and we are looking forward to the years ahead!

Working with QuantStreet

QuantStreet is a registered investment advisor. We offer wealth planning, separately managed accounts, model portfolios and portfolio analytics, as well as consulting services to our clients. Our approach is systematic and data-driven, but also shaped by years of investing experience. If you are an existing client or if you are thinking about working with us, please reach out at hello@quantstreetcapital.com.

Cover picture generated by Gemini.

[1] Efficient means that portfolios have the highest possible expected return at each risk level, given our return forecasts and portfolio constraints, like sector limits and no short sales.

[2] The table assumes a QuantStreet management fee of 40 basis points. This fee varies across strategies and clients. More information about our performance and that of specific benchmarks is available on our website.

[3] We custody at Schwab and generally do not have access to other managers’ money market funds. However, we have no monetary or other incentives to invest client assets in Schwab’s, or anyone else’s, products.

[4] These are the fees paid to the institutions that manage the ETFs in which we invest. These fees do not include what QuantStreet chargers for its services.

[5] If you would like more information about the portfolios analyzed in this table, please reach out to us at hello@quantstreetcapital.com.