April 3, 2024 —

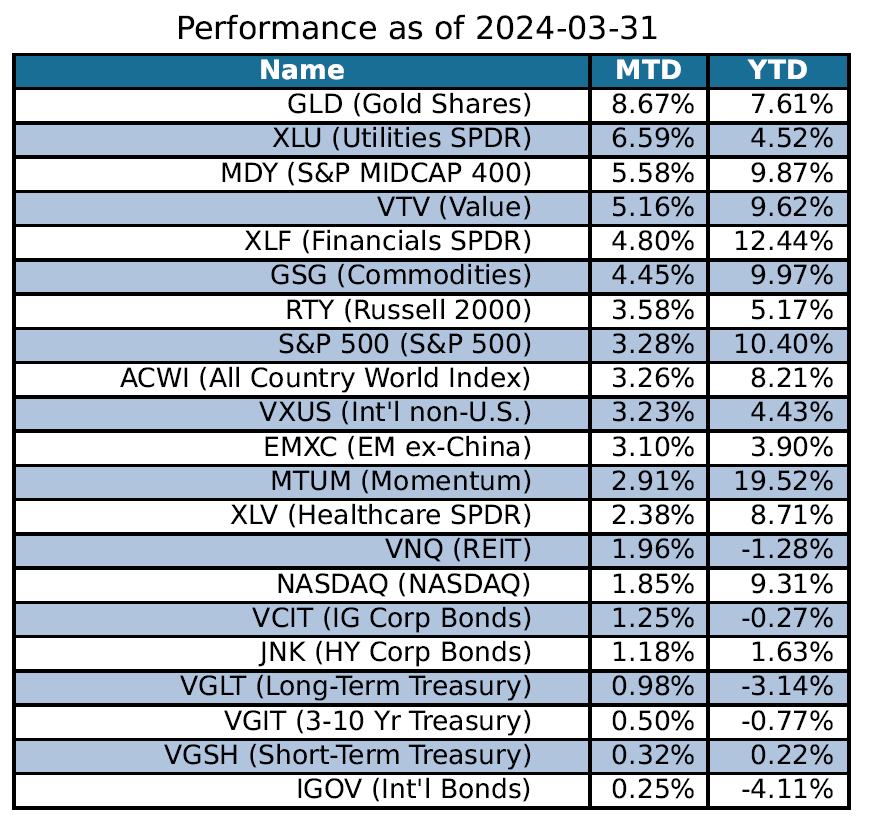

As hints of spring emerged in an unseasonably warm March, markets continued to rally, with the S&P 500 up over 3%. Gold was a strong performer on the month, as were many of the prior-year laggards, like utilities, midcaps, and small caps. We wrote about our views on gold — positive expected returns based on QuantStreet’s machine learning forecasting model with the catalyst of expected Fed easing later in 2024 — in our March 2024 investor letter, as well as in a more detailed piece on Advisor Perspectives (more below). Tech took a bit of a breather, with the Nasdaq up “only” 1.85% (an otherwise terrific return but a bit subpar in March 2024).

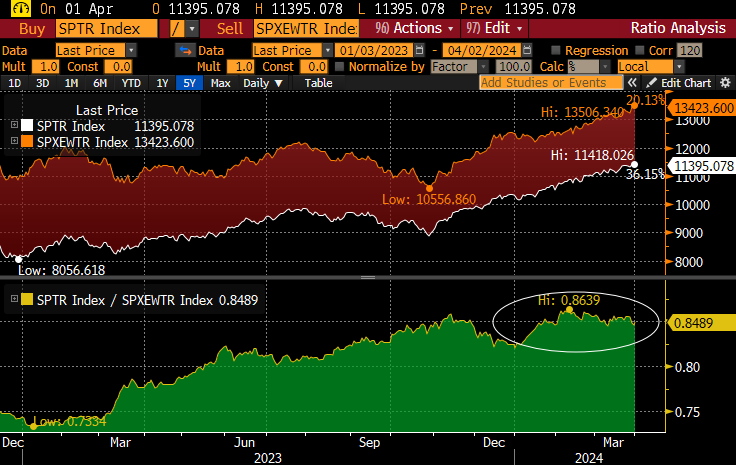

The fact that the laggards are starting to pull their own weight is being interpreted positively by market commentators, who argue that a broadening of the last-twelve-month rally would be a good thing for markets (though others, like Goldman Sachs, argue that the S&P 500 is not overly top-heavy). One way to see this broadening is to compare the performance of the tech heavy S&P 500 index, with roughly 28% in six companies (Microsoft, Apple, Nvidia, Amazon, Meta, Google), to that of the equal-weighted S&P 500 index, where the allocation to these (or any other) six firms is roughly 1.2% (i.e., 6 divided by 500).

Starting in 2023, the top-heavy S&P 500 outperformed its equal-weighted cousin by over 17% (39% vs. 22%) since January 1st, 2023. But over the last few months, the two indexes have been moving more or less in line with each other, as the circled area in the plot below shows.

We are not taking a stand on whether under- or outperformance of the equal-weighted vs. the value-weighted S&P 500 index is a good or bad thing for future market returns, but it is a dynamic we plan to investigate.

Two more charts are worth emphasizing. First, inflation (PCE CYOY in the chart) has been trending down, despite generally strong economic growth and low (though starting to trend higher) unemployment. Fed funds futures are now calling for just over two rate cuts for the rest of 2024, which is down from an estimate of three cuts earlier in the year. At the same time, energy prices (CL1 in the chart) are rising on continuing Middle East tensions (and presumably many other factors as well). Our positioning reflect our view (discussed here) that the Fed will start its easing cycle in 2024. But inflation and commodity dynamics all bear watching, since they will have first order impacts on financial markets.

Portfolio updates

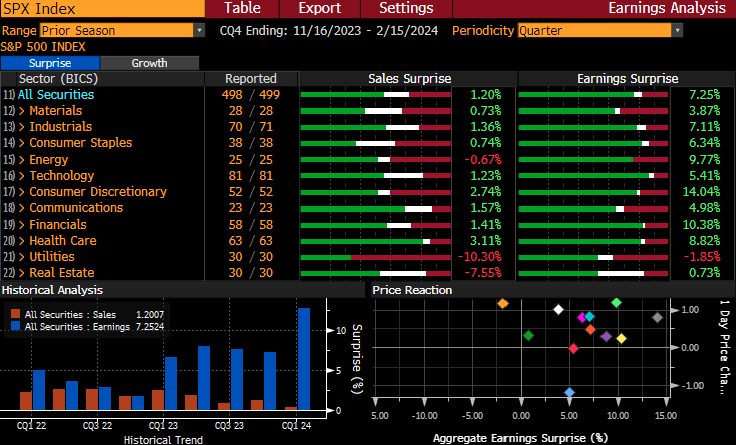

Our macro view is that the Fed will begin to ease later in 2024 on the back of falling inflation, though the economy and the corporate sector are in good shape. The last earnings season (see next chart) was a strong one, with a larger-than-usual set of earnings surprises (blue bars in the next chart). With bank earnings kicking off Q1 earnings reporting late next week, much more information about the state of corporate profitability will soon be available to investors.

We did not make major changes to our portfolio allocations across our risk-targeted portfolio. We slightly increased gold, healthcare, and S&P 500 exposures, and slightly decreased our position in QQQs. We remain bullish on the QQQs but our process driven portfolio allocation approach found slightly better reward-to-risk opportunities in the other asset classes. For those wanting more detail about our portfolio compositions, month-over-month changes in these, and in-depth reasoning behind these decisions, please reach out to us at hello@quantstreetcapital.com to discuss our model portfolio research offering.

Research

In March 2024, we published two piece on Advisor Perspectives. In the first, we ask what Enron can teach us about Nvidia’s stock price runup. We’ve all seen the research pieces where someone juxtaposes a price chart showing the runup and bursting of a historical stock bubble (e.g., Enron) with the price runup of a current highflyer. The implicit, or explicit, argument is that since the former highflyer suffered a large price drop, the current highflyer inevitably will as well. In our note we make the point that this argument is just statistical cherry picking, with little, if any, practical takeaways.

In the second piece, we lay out our case for why gold is an interesting asset to hold in client portfolios, at least for the time being. Our three reasons are: QuantStreet’s valuation models have historically had good explanatory power for future gold returns and currently favor the asset class; gold’s correlation with many risk assets is very low, suggesting it provides a good diversification benefit for most portfolios; and the impending Fed-easing (though pushed back somewhat due to recent strong economic growth numbers) coupled with the fact that gold has historically done well in Fed easing cycles. Finally, it is interesting to note that, though gold checks some of the same boxes that lead investors to buy bitcoin, the price of gold denominated in bitcoin is at an all time low.

Finally, we did some experimentation with how new large language models (LLMs), a type of AI algorithm, can be helpful for investors in their financial decision making. We asked Google’s Gemini LLM to summarize past drawdowns of the Nasdaq index. The answers were good, though far from perfect. But we argue in the piece that market participants should be taking AI very seriously and thinking carefully how they can use these tools to make better investing decisions. We certainly are devoting a lot of our HI (human intelligence) to thinking about such matters.

To receive these research pieces in real-time, please sign up for QuantStreet’s Substack page.

Working with QuantStreet

QuantStreet offers wealth planning, separately managed accounts, model portfolios, and consulting services to our clients. If you are an existing client or if you are thinking about working with us, we’d love to hear from you. Please reach out to us at hello@quantstreetcapital.com.

Photo by Terence Starkey on Unsplash.