November 17, 2025 —

Carlota Perez, in her book Technological Revolutions and Financial Capital, argues technological revolutions occur in (roughly) 50-year cycles. She identifies five such episodes, starting with the Industrial Revolution in Britain in 1771 and ending with the information and telecommunications revolution in the U.S. in 1971.

|

Revolution |

Start Date |

End Date |

|

The Industrial Revolution |

1771 |

1829 |

|

Age of Steam and Railways |

1829 |

1873 |

|

Age of Steel, Electricity, and Heavy Engineering |

1875 |

1918 |

|

Age of Oil, the Automobile, and Mass Production |

1908 |

1974 |

|

Age of Information and Telecommunications |

1971 |

– |

Source: Perez, Technological Revolutions and Financial Capital

In light of the start of the AI revolution—which arguably began on November 30, 2022 with the introduction of ChatGPT—almost exactly 50 years after the start of the information and telecommunications revolution, her book, published in 2002, appears especially prescient.

Perez argues that each revolution proceeds in four phases:

- The irruption phase sees the introduction of the new technology to the world.

- This is followed by the frenzy stage when society begins to understand the power of the new technology, and invests resources in its development. She argues that the interaction of financial capital and technological change ultimately leads to a market crash at the end of the frenzy stage.

- At this point, the synergy stage begins, where the best uses of the technology are discovered and resources are efficiently funneled into supporting these.

- Finally, the revolution enters its maturity phase, at which point most investments have already been made, and the technology settles into the fabric of ordinary life. At this point, a new “great surge” begins as another revolutionary technology enters the public consciousness.

Against this backdrop, Perez produces timelines of the five great technological revolutions. In her estimation, the Industrial Revolution started in 1771 and lasted through 1829. At this point, the Age of Steam and Railways began, lasting until 1873. In 1875, steel, electricity, and heavy engineering carried the baton until 1918. The Age of Oil, Automobiles, and Mass Production began in 1908, overlapping for a decade with the end of the prior technological epoch. This lasted until 1974. Finally, the Information and Telecommunications Age began in 1971 and had not yet run its course when the book was published in 2002.

Financial markets and technological revolutions

Our contribution is to connect Perez’s timelines with stock return data, which we obtain from the macrohistory.net website. This data set covers annual economic and market statistics about 18 developed market economies, starting in 1870.

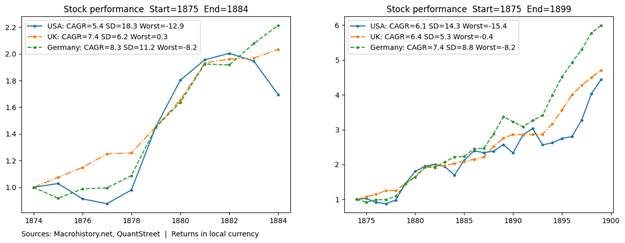

The next chart shows the value of 1 unit of local currency invested into the U.S., U.K., and German markets starting at the end of 1874. The left panel zooms in on the first ten years of data. The legend shows the compounded annual growth rate (CAGR) of each market, as well as the annual volatility and the worst one-year performance in the sample period.

In the ten years following the 1875 start of the Age of Steel, Electricity, and Heavy Engineering, world stock markets were up between 5.4% and 8.3% per year. The worst one-year performance was -12.9% in the U.S. in 1884. The selloff in the U.S. market in 1876 and 1877 represents the tail-end of the Long Depression of 1873-1877, which began in response to overinvestment in railroads, the focus of the prior (1829) technological revolution. The right panel extends the analysis window to 25 years, through 1899. Over this time, the compounded annual growth rate was between 6.1% and 7.4%. The worst one-year return was -15.4% in the U.S. in 1893. Overall, the Age of Steel, Electricity, and Heavy Engineering saw reasonably robust stock market performance for the next 25 years.

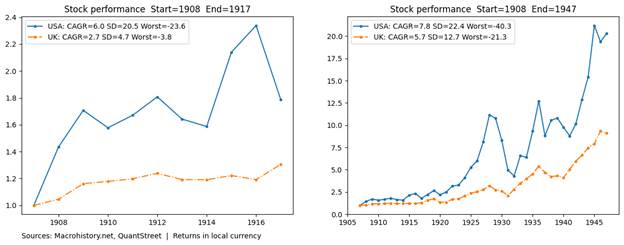

The next chart shows the ten- and 40-year performance after the 1908 start of the Age of Oil, Automobiles, and Mass Production. The left panel shows that in the ten-year period after the end of 1907, the U.S. market was up 6% per year, with a worst one-year return of -23.6% in 1917, ten years after the start of this technological epoch.

The right panel shows that extending the analysis to the end of World War II captures the market crash that happened during the Great Depression. Over 1930 and 1931, the U.S. market was down 54%. The U.S. market would not sustainably reach a new high until the early 1940s, over ten years after the start of crash. The market crash associated with the Great Depression, even if it was partially caused by technological overinvestment (which is not the common narrative), still happened 20 years after the start of the oil and automobile age.

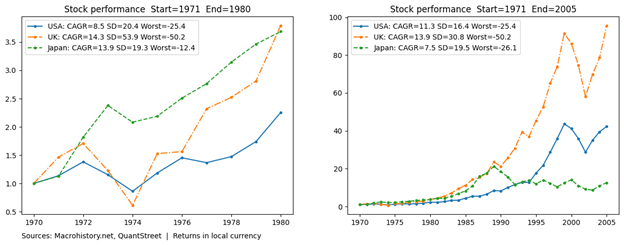

Finally, the start of the information and telecommunications revolution saw strong global market returns from the end of 1970 until 1980, with CAGRs of 8.5% to 14.3% per year, as seen in the left panel of the next graph. However, both the U.S. and U.K. markets experienced severe strains in 1973 and 1974, down 38% and 64% respectively, due to the 1973 oil price shock. This shock was caused by conflict in the Middle East and was not directly related to the technological revolution itself.

Expanding the analysis to the 35-year period after 1971 shows annualized returns between 7.5% and 13.9%. There were two more large shocks in this extended time frame. First, the Japanese market was down 46% in between 1990 and 1992, largely due to the bursting of the Japanese asset bubble. The U.S. and U.K. markets would continue to set new highs until the bursting of the dot-com bubble from 2000 to 2002, a period over which the U.S. stock market was down 34% when measured using end-of-year prices. While the dot-com selloff was attributable to overly exuberant tech company valuations, the bubble did not materialize until almost 30 years after this tech epoch began in 1971.

The Age of AI

Arguably the Age of AI began with the November 30, 2022 introduction of ChatGPT. This set in motion an unprecedented rush to develop the software and hardware infrastructure needed to support the AI revolution.

Taking 2022 as the starting point, thus far the annualized rates of return across global markets have been from 7.4% to 11%. This is higher than the CAGRs in the ten-year windows following 1875 and 1908, but in line with the ten-year window following 1971.

History shows that the starting points of technological revolutions are not invariably followed by the onset of large stock market selloffs, though certainly the latter do occur in the subsequent years and decades. What comes next this time around is a topic for another day, but the historical precedent we obtain from Perez’s book coupled with the macrohistory.net data provides a bit of guidance.

Working with QuantStreet

QuantStreet is a registered investment advisor. It offers financial planning, separately managed accounts, model portfolios and portfolio analytics, as well as consulting services. The firm’s approach is systematic, data-driven, and shaped by years of investing experience. To work with or learn more about QuantStreet, contact us at hello@quantstreetcapital.com or sign up for our email list.