August 31, 2025 –

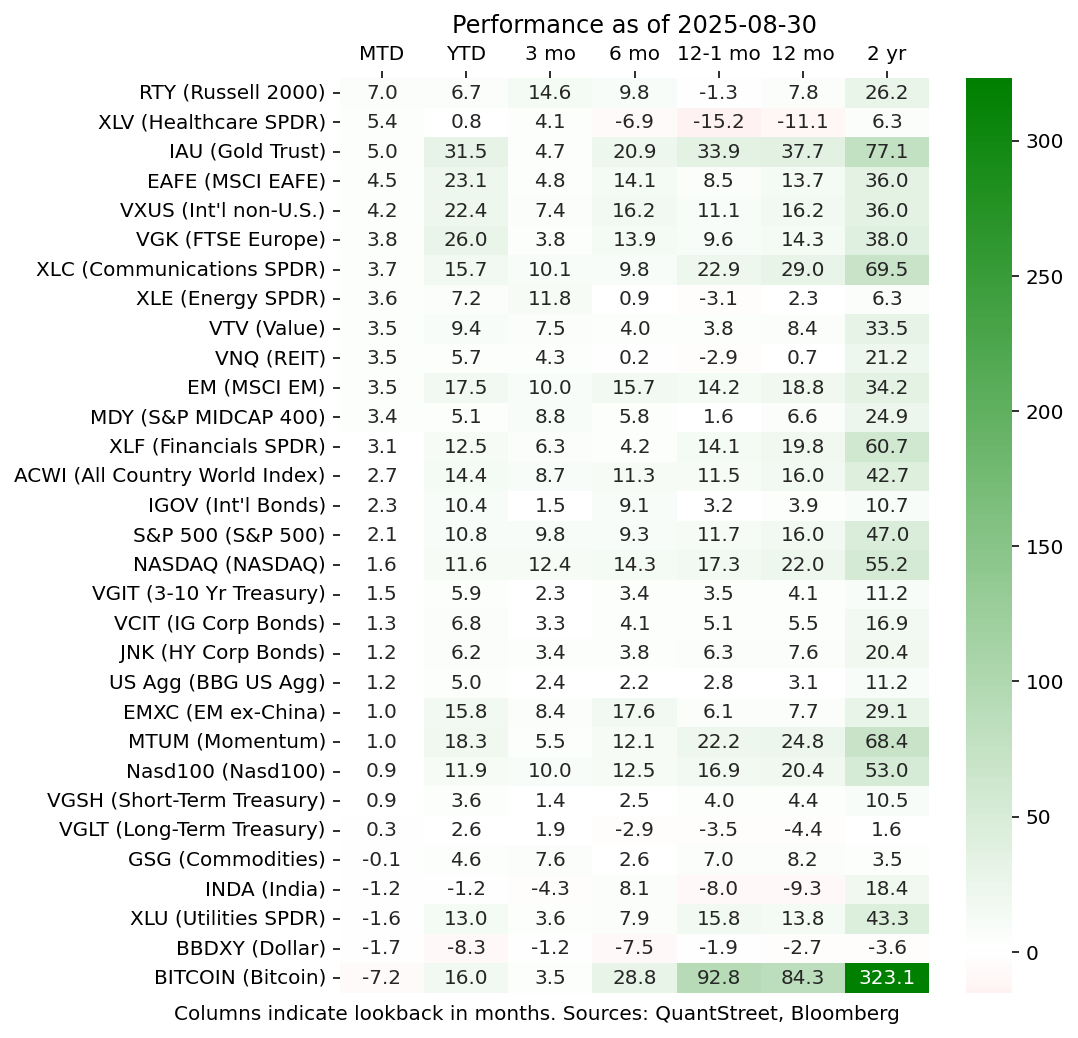

An important market event in August was Jay Powell’s August 22nd speech at Jackson Hole. The market interpreted his remarks as indicative of a more dovish monetary policy stance and has, at this point, fully price in a 25 basis point rate cut for the September 17th FOMC meeting. Risk assets did well in August, especially small caps and international assets in dollar terms, the latter due to continuing dollar weakness. Nvidia released its Q2 earnings on August 27th, and despite some modest market disappointment relative to sky-high expectations, the overall trend in AI demand remains strong.

Bitcoin took a bit of a breather after its recent breakneck rally, and utilities were down, though still doing very well year-to-date. The dollar—the market’s punching bag for all things it dislikes about the trajectory of US policy—continued to weaken. As to QuantStreet, you can see our performance results here.

Mounting concerns

President Trump’s attempted firing of Fed Governor Lisa Cook is sending further jitters among investors, whose nerves are already frayed by the administration’s trade policies. The 2s-30s curve (the difference in yields between 30- and 2-year Treasuries) is at its widest point in several years.

This reflects two things. First, the market expects lower short-term rates, partially on the back of pressure from the Trump administration for the Fed to ease and partially on the back of what appears to be a slowing job market and a weakening US consumer. Second, the market and prominent commentators (Janet Yellen, for example) are concerned about the weakening of Fed independence, the impact this will have on longer-dated inflation expectations, and the impact of ever-increasing budget deficits and a growing debt load. These are all reflected in rising long-dated yields.

An ever-growing litany of investor concerns now includes:

- deteriorating Fed independence;

- unsustainable budget deficit and debt trajectory in the US (see Niall Ferguson’s interesting piece in the Wall Street Journal on what happens when a country’s interest expense overtakes its defense spending, as seems to be happening now in the US);

- government interference in the market mechanism (see Jason Zweig’s recent piece on the US government’s 10% Intel stake and our piece on a similar topic from last year);

- the resultant decline of the dollar’s reserve currency status;

- and, a valuation bubble that is building on the back of investor enthusiasm about AI.

Another concern, though not much talked about in the media (yet), also bears watching:

- the medium-term impacts of the Trump administration’s deregulatory agenda on financial stability.

In our opinion, all of these legitimate concerns are, to various degrees, already priced into financial markets. The impact of these on the ongoing stock market rally will depend on their trajectory relative to investor expectations.

Potential market impacts

It is hard to argue that interference with the Fed will lead to positive outcomes in the long-run. In the short-term, though, the Trump administration is likely to nominate a new Fed chair who will be more attentive to political considerations that Powell is, which will lead to a lower Fed policy rate than what may be warranted by fundamentals.

The US budget deficit seems clearly unsustainable and the only solution will be to raise taxes. Whether this happens voluntarily or because the market forces policy makers’ hands remains to be seen. Our hope, of course, is the former scenario plays out, but the tail risk from the latter is certainly there. Furthermore, it is hard to argue that US government stakes in private companies will lead to better capital allocation outcomes.

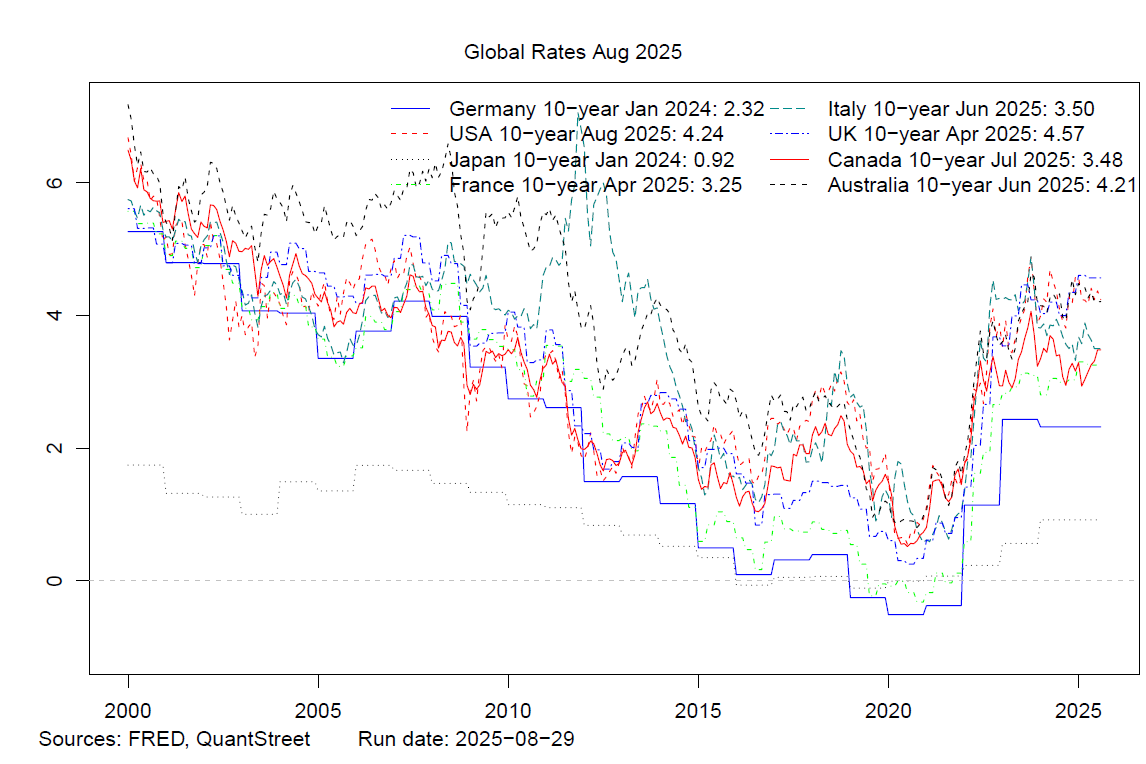

Taken together, these trends seem clearly dollar negative: lower short-term rates, degradation of Fed independence, high future debt loads, and deteriorating free market principles. The countervailing consideration is that longer-dated US interest rate levels are considerably higher than those of peer developed market economies, as the next chart shows.

An overly dovish Fed will, if anything, push medium- and long-term interest rates higher, not lower, which will provide support for the dollar. Furthermore, the US leads the developed market pack of countries in economic growth. Our hunch is these factors will balance out. The growth and rate differential story points to a much higher dollar, but the headwinds of policy concerns will likely not allow that to happen.

But an overly dovish Fed will be unambiguously positive for economically sensitive assets (small- and mid-caps), rate sensitive sectors (like utilities with their high dividend yields and tech firms with long-dated cash flows), and zero-carry assets like gold (which will be further supported by continuing questions about the dollar’s reserve currency status). At QuantStreet, we slightly increased our utility and tech exposures this month on the back of these and other model-based considerations. We maintain our short-duration bias and also our gold exposures.

As for the AI bubble argument, we’ve written about this in the past and our views remain unchanged. First, price-to-earnings ratios have done a lousy job of forecasting stock market returns in the recent past and we don’t think this is likely to change any time soon. Second, a cash-flow analysis suggests that US stocks’ higher valuation multiples are almost entirely offset by anticipated higher earnings growth rates. The net result is that US stocks look more or less in line with their global peers from a valuation perspective, and are poised to outperform if the AI revolution accelerates US growth relative to that of other countries (which seems like a reasonable base case to us).

Finally, we believe that there will be payback for financial deregulation (though hopefully not as extreme as what we saw during the global financial crisis of 2007-2009), but this is not imminent. In the short-run, deregulation will go in the direction of potentially lower-than-warranted short-term interest rates, and be a market positive.

Interviews

Recently, Harry appeared on two podcasts and was interviewed for an AI in finance blog. If you are interested, you can check these out at:

If you have thoughts on any of these, we’d love to hear from you.

Working with QuantStreet

QuantStreet is a registered investment advisor. It offers wealth planning, separately managed accounts, model portfolios and portfolio analytics, as well as financial consulting services. The firm’s approach is systematic, data-driven, and shaped by years of investing experience. To work with or learn more about QuantStreet, join our mailing list or contact us at hello@quantstreetcapital.com.

Please keep in mind that all financial forecasts are fraught with risk and uncertainty. Our views may prove incorrect and market outcomes may be materially worse than we anticipate. Please see our full disclosure about the limitations of financial forecasts and the risks of investing at https://quantstreetcapital.com/terms-of-use/.