October 5, 2025 –

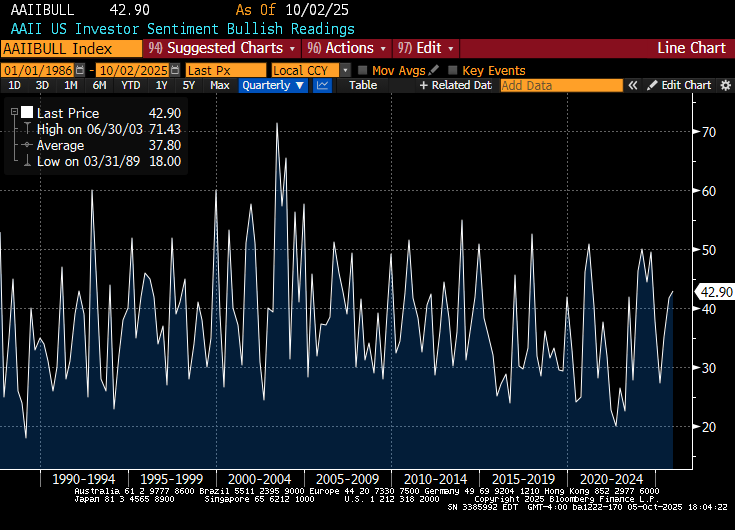

The market is in a funny place. September was a strong month for financial markets, its typical negative seasonality notwithstanding. However, news narratives over the last few weeks have, with good reason, become progressively more negative. At the same time, investor sentiment–usually a contrarian indicator–is very much middle-of-the-road, as the next chart shows.

Before discussing the causes underlying the negative tone of economic narratives, a few quick notes:

- At QuantStreet, we generate two sets of model portfolios each month. The first, which we call our strategic portfolios, reflects the return-risk tradeoffs from a historical analysis of asset class return data. The second, our tactical portfolios, reflect return forecasts from our machine learning forecasting models combined with more recent risk estimates. We’ve been hard at work revising our strategic portfolios to reflect the best-in-class thinking of existing Wall Street asset allocation products. A first step towards this goal is summarized in our recent piece on replicating target date funds. We are continuing to work on this problem and are close to implementing a different–and we believe richer–strategic allocation process which reflects asset class return forecasts implicit in the asset allocation advice Wall Street gives to its clients. You’ll hear more about this in the coming weeks.

- Harry recently had a fireside chat with C.S. Venkatakrishnan (Venkat), the CEO of Barclays, when Venkat visited Columbia Business School. Topics of discussion included general career advice from Venkat, as well as his views on the finance industry, AI, and climate change. You can read more about the event, as well as watch a video of the fireside chat, here.

Concerns

Turning to the negative narratives that have been receiving much attention in the financial press of late, let us consider four important areas of concern and how these impact QuantStreet’s asset allocation decisions.

- Continued geopolitical instability. The war in Ukraine and the Israeli-Palestinian conflict continue to rage. Surprisingly, the news here has veered slightly positive on the back of the Trump administration’s recent peace initiative, though much has yet to be determined about its ultimate implementation. Alleged Russian incursions into NATO airspace are a new and highly destabilizing development. Overall, our view is the news flow here is neither better nor worse than it’s been in the last few months.

- Stagflation. It doesn’t help that the political deadlock in DC delayed the release of this past Friday’s jobs numbers. Based on earlier data, jobs creation in the U.S. economy is slowing, while inflation remains stubbornly above the Fed’s 2% target. I am not in the stagflation camp, but jobs and inflation developments bear watching. Should inflation pick up a bit and the jobs market continue to slow, the Fed will be in a very tough position, torn between its dual mandate of price stability and full employment.

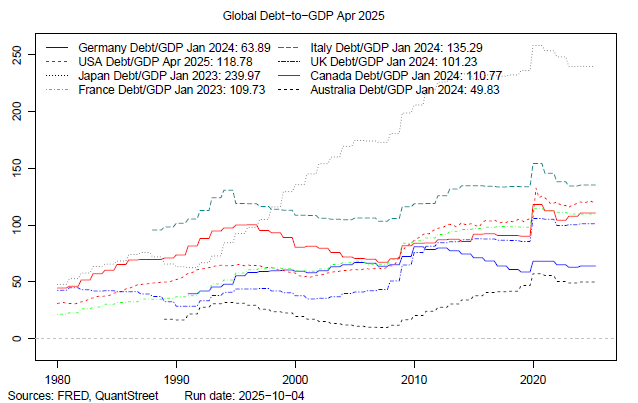

- Budget deficit and debt load. There are legitimate concerns about debt sustainability in the U.S., and more broadly across other developed market economies (see below). Add to this ongoing budget deficits across each of these economies and the aforementioned political deadlock in Washington, and it makes it hard to ignore this particular concern. The 2s-30s curve (difference in yields between the 30-year and 2-year Treasuries) continues to steepen, reflecting investor unease about owning long-dated U.S. government bonds. The dollar remains weak (though, admittedly, a good deal of this weakness stems from U.S. politics rather than our debt load) and gold and bitcoin continue their seemingly unstoppable ascent. Both trends reflect chinks in the armor of the dollar’s reserve currency status. Our take is these are legitimate issues and there will be a price to pay, in the form of higher taxes, though likely not in the short term.

- AI bubble and debt-financed build out. Talk of an AI bubble is not new and I’ve written in the past that price-to-earnings ratios are lousy forecasters of future market returns (though perhaps less lousy at the sector level, where many sectors appear rich based on price multiples) and that the U.S. market is not in a bubble (as of early 2025). What’s new is that Bezos, Altman, and Zuckerberg all mentioned the b-word as well, though in a nuanced way suggesting that things could ultimately work out okay. More worrying is the hard data: the dollars being spent on the AI build out are huge, and estimates of future AI revenue needed to justify the current spend are in the trillions of dollars. More worrying still is the fact that more and more of the AI build out is being financed with debt. The multitude of historical debt-fueled overinvestment episodes suggests caution. The question, of course, is timing. Based on our own increasingly frequent use of AI at QuantStreet, we suspect the AI investment boom hasn’t yet hit the overinvestment threshold, but this is obviously a subjective and anecdotal analysis. Though tech bulls, like Dan Ives of Wedbush, agree with this assessment.

Looking ahead

The list of concerns is surely longer than just these four issues. At the same time, however, corporate earnings are strong. The U.S. economy is still growing. The Fed is being accommodative, and may be forced to be overly accommodative by political pressure (bad in the long run but not in the short term). Deregulation and an anticipated pick-up in M&A will also provide market tailwinds.

Our feeling is that a catalyst will be needed to translate the above concerns into a market sell off. For what it’s worth, QuantStreet’s large sell-off model is sanguine at the moment, with a very low forecasted probability of seeing a greater than 20% sell off in the next year. We have a positive view of global, and especially of U.S., equity markets. Our view for the month ahead is to stay the course, despite the multiple legitimate concerns detailed above. QuantStreet’s September performance details are available here.

Working with QuantStreet

QuantStreet is a registered investment advisor. It offers wealth planning, separately managed accounts, model portfolios and portfolio analytics, as well as financial consulting services. The firm’s approach is systematic, data-driven, and shaped by years of investing experience. To work with or learn more about QuantStreet, join our mailing list or contact us at hello@quantstreetcapital.com.

Please keep in mind that all financial forecasts are fraught with risk and uncertainty. Our views may prove incorrect and market outcomes may be materially worse than we anticipate. Please see our full disclosure about the limitations of financial forecasts and the risks of investing at https://quantstreetcapital.com/terms-of-use/.

Picture source: Google Gemini