June 1, 2025 –

Amid a fair amount of market tumult, we wrote two months ago that the best course of action was to stay invested in roughly the same portfolios that we’ve had throughout, and let the market stabilize. This stabilization started in May as many of 2025’s laggards rallied, including, at long last, the U.S. stock market, which chalked up a +6.3% return in the month, with the tech-heavy Nasdaq doing even better. The year’s big winners–all things international–did well too though not quite as well as U.S. assets in May. The dollar, however, has yet to find its footing, and was down 0.6% in May. Topping the charts in May was bitcoin, with a +11.2% return, though not everyone is a believer (here’s a sobering piece by Paul Krugman). Our view has been to watch bitcoin from the sidelines as we still can’t quite wrap our mind around this investment thesis.

You can see QuantStreet’s May performance here.

Looking back to the start of the year, we are in an unusual, though not unprecedented, period of U.S. underperformance. In dollar terms, global stocks markets have outperformed the U.S. by between 14% to 21%. Thus far in 2025 the dollar is down 6.7%. The reasons are well known at this point. The market perceives the Trump administration’s policies to be erratic. The April 2nd tariffs announcement was, to put it mildly, not well received by financial markets. The term “TACO” (meaning “Trump always chickens out”) has caught on with the social and traditional media. The U.S. budget deficit is high and likely going higher, leading some to question the dollar’s status as the global reserve currency and causing Treasury yields to increase. For those looking, the negatives abound.

Taking a closer look

Keynes famously (and supposedly) said that “When the facts change, I change my mind. What do you do, sir?” This quote is perceived to reflect Keynes’ wisdom in the ways of the world and financial markets. But when President Trump changed his mind about the initial structure of his trade policy in response to market and economic facts, he is derided as being “chicken.” This is astounding. Would it have been better that he stuck to his original, poorly received policies, which were crashing stocks, the dollar, and U.S. Treasuries, just to appear steadfast? It seems to us far better that the Trump administration changed its mind in response to the facts. Policymaking is very hard, and changing policies that don’t work is a hallmark of good decision making, rather than a sign of being “chicken.”

Secondly, as often happens with President Trump, despite the bluster and the chaos, he has a point. The U.S. has a manufacturing problem relative to China, as was starkly pointed out by the Wall Street Journal in a recent piece showing that China’s manufacturing capacity–much of which can be used for miliary means–far outstrips that of the U.S. In addition, the U.S. is dangerously reliant on China for rare earth metals. In peacetime, this means we can’t manufacture as many cars as we’d like. But in wartime, this is a first order national security issue. While one may criticize the Trump administration’s approach to these problems (and many have), the problems are real and need to be addressed at the highest levels of decision making in this country.

Related to the above, it is unlikely that manufacturing capacity will come back to the U.S. in its labor-intensive form from many decades ago. Instead, the future of U.S. and global manufacturing lies in automation. The path to higher automation is through AI, as Jensen Huang, the CEO of Nvidia, recently pointed out. (Dario Amodei, the CEO of Anthropic, recently made a similar point.) It is hard to imagine what the demand for AI will look like once every physical manufacturing facility needs to have its own AI server farm to keep the machines running. The U.S. is far and away the global leader in the production and adoption of AI technologies, though China is likely catching up. Bringing hundreds of billions of dollars of semiconductor and other high-tech manufacturing capacity to the U.S., which the Trump administration is doing, is also a major positive.

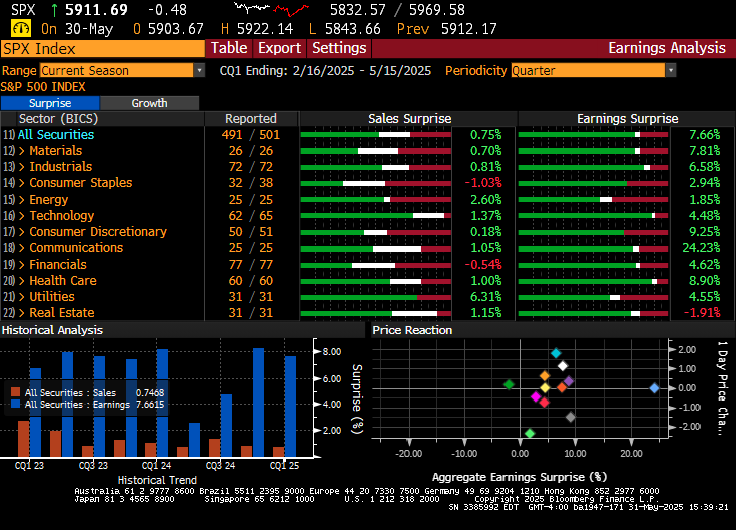

Now that we are starting to see corporate earnings and macroeconomic data which reflect the administration’s tariff policies, things are far less cataclysmic than forecasted. The corporate earnings season has been strong, especially in tech. Hard macroeconomic data points in the U.S. are reasonably robust, though forward looking survey data looks weaker, and the U.S. consumer remains quite gloomy. Even James Mackintosh of the Wall Street Journal, not a perennial bull, wrote recently that tariffs are unlikely to cause an economic disaster.

With regard to the emerging narrative of U.S. fiscal deficits and large debt load, it should be noted that the U.S. is in the middle of the pack of other developed countries. Our government debt to GDP level, in the 120% range, is just a shade above that of the U.K. and France, but below Italy and well below Japan, though both of the latter have a lower level of 10-year government interest rates than we do in the U.S. While there are plenty of legitimate concerns about the sustainability of our spending and debt load over the intermediate term (see this recent warning from Jamie Dimon, the CEO of JPMorgan), it hard to argue that current U.S. 10-year rates are so high because our fiscal and debt situations are globally anomalous. They are not.

Looking ahead

While our views about the U.S. are sanguine, and bordering on outright bullish, at QuantStreet we follow a process-driven asset allocation approach. Our forward-looking return signals consist of two parts: a machine learning forecast of one-year ahead returns for each asset class blended with that asset class’s returns over the prior year, excluding the most recent month (e.g., the trend signal as of the start of January 2025 contains returns from January 2024 to November 2024, but excludes those from December 2024). Based on this blended signal, we increase our allocation to European markets in our June 2025 portfolio rebalance. We initiated a small position in European equities as of early 2025 based on a standalone analysis of the attractiveness of European vs. U.S. markets, and we are now adding to this position as our allocation signal finally lines up with our qualitative view.

Unfortunately, the pace of the move in European stocks since the start of the year has been remarkably fast and our increased allocation now is happening after an already large move. Fortunately, one of the important benefits of having a systematic investment process is not allowing regret to stand in the way of rational portfolio decisions. To make room for the heavier international allocation, we take our high-yield bond allocations across all portfolios to zero, and in some cases we slightly reduce our S&P 500 allocations as well. Should the relative value signal of international (and European) stocks begin to look more attractive relative to the U.S., we will increase our international allocation, though we are bullish on the U.S. market (and maintain a large overweight to the latter).

Finally, on the wonky portfolio allocation side of things, we’ve always followed two sets of risk measures across our portfolios: (1) the volatility of returns and (2) a tail risk measure which estimates how our portfolios would perform in a 1-in-20 bad year for the s&P 500 index. While historically our portfolio allocations have explicitly considered only volatility limits, we are now incorporating tail risk constraints directly into our tactical portfolio optimization process. If you would like to learn more about this feature of our allocation process, please reach out.

Working with QuantStreet

QuantStreet is a registered investment advisor. It offers wealth planning, separately managed accounts, model portfolios and portfolio analytics, as well as financial consulting services. The firm’s approach is systematic, data-driven, and shaped by years of investing experience. To work with or learn more about QuantStreet, join our mailing list or contact us at hello@quantstreetcapital.com.