January 3, 2026 –

With 2025 in the books, we take a brief pause to reflect on QuantStreet over the last few years. We started managing our first portfolio in December of 2021. What started out as just an idea has grown into a business serving many clients, both retail and institutional. 2025 was a year of growth for QuantStreet, and we hope to continue to build on this in 2026. We are grateful to our clients for putting their trust in us. And we commit to continued hard work to better serve our clients and help them achieve their financial goals.

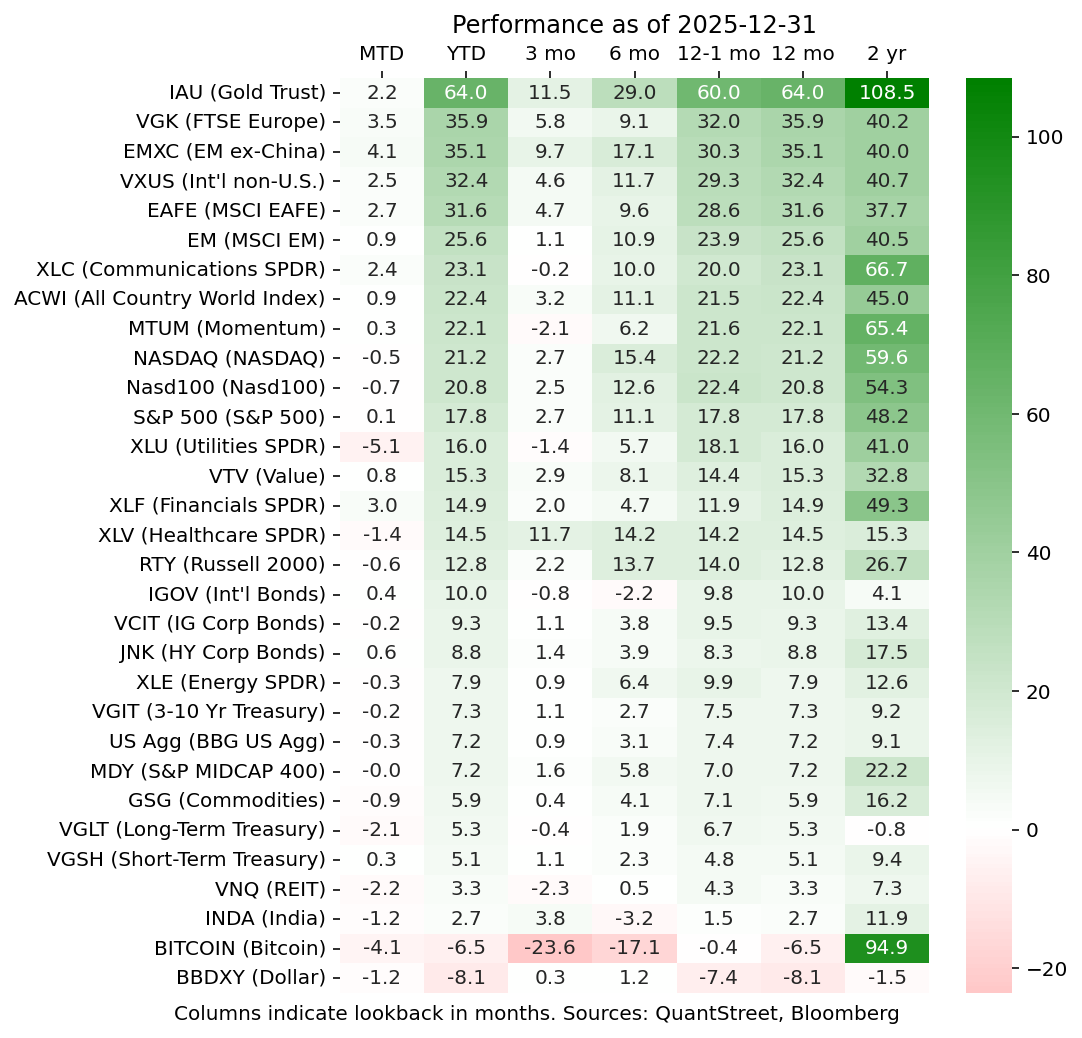

2025 saw a reversal of a long-standing trend of U.S. outperformance relative to the rest of the world. U.S. risk assets lagged their global peers in local currency terms, and especially in dollar terms thanks to the dollar’s 8% depreciation in 2025. For reasons we’ve discussed in the past, gold was the leading risk asset in the world, followed by all manner of global stock market, Europe, EM, and the rest of the world more broadly. Within the U.S., tech and communications continued to lead the way, with U.S. markets broadly posting a more-than-respectable 17.8% return on the year.

Even fixed income eked out some gains, with intermediate duration U.S. Treasuries posting 7.3% returns in 2025 and short-term (very low risk) U.S. Treasuries returning 5.1%. High yield bond, despite all-time historically low spreads, did well with an 8.8% return, slightly surpassed by investment grade bonds, which were up 9.3%. Despite the tariff tempest of April, 2025 ended up a good year all around for risk assets.

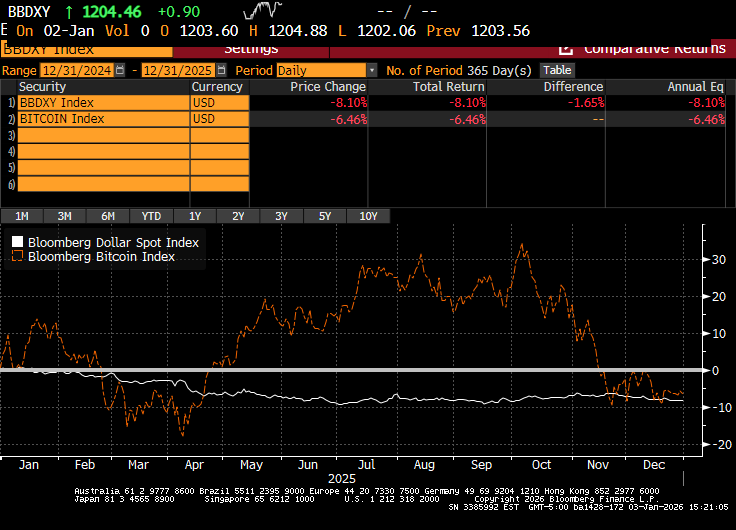

Excluded from the party, however, were two asset class. The dollar was kicked out of the festivities early on and never managed to claw its way back. Bitcoin–for reasons that have never been clear to us–was having a great year up until early October, when it suffered its own swoon, ending the year just shy of the dollar’s losses (which means bitcoin in non-dollar terms had an even more miserable year).

Our view on the dollar has transitioned from neutral towards moderately bearish. To us, the main forces impacting the dollar are:

- concerns about U.S. foreign policy and Fed independence;

- the fact that the Trump administration wants a weaker dollar (it would help our trade deficit) and generally the Trump administration gets what it wants;

- gradual weakening of the dollar’s global reserve currency status;

- the dollar’s rich valuation on a trade- and inflation-adjusted basis.

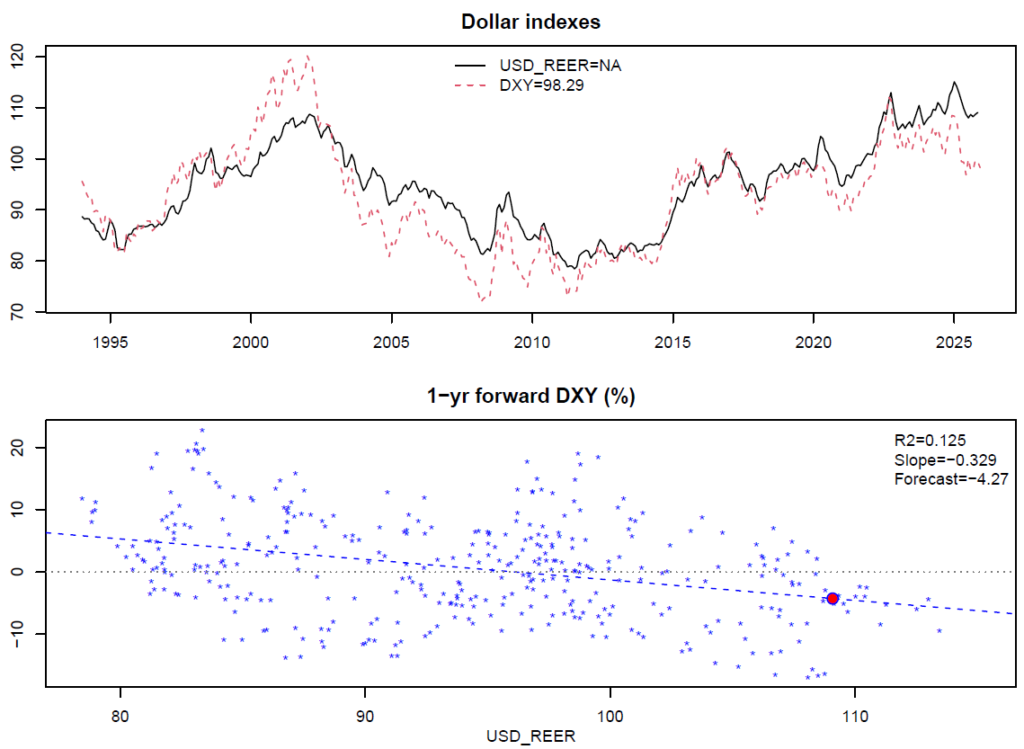

One important measure of the dollar’s valuation is the BIS real effective exchange rate which measures, roughly speaking, the trade-weighted cost to foreigners of buying a basket of U.S. goods divided by the cost of buying (a sort of similar) basket of their own domestic goods. The higher this ratio, the richer are U.S. products relative to non-U.S. ones. As the next chart shows (black line) the dollar real effective exchange rate (REER) is at multi-year highs despite the dollar’s 2025 selloff. We will write more about this on our Substack, so if you don’t already subscribe please do so here.

What’s more, a high dollar REER has historically been a good predictor of future dollar depreciation (see bottom chart which we’ll explain further in our upcoming Substack piece). One mechanism for this is that, with an expensive dollar, U.S. consumers buy more foreign goods (exactly what the Trump administration does not want) driving up their prices and driving down the prices of U.S. goods, while at the same time sending many dollars abroad and thus weakening the value of the dollar. Should this dynamic play out, the dollar may continue to decline in coming years, which will provide a catalyst for the dollar performance of foreign stocks from the point of view of U.S. investors.

The one major positive for the dollar, which also applies to the U.S. stock market, is that the U.S. economy is very strong and U.S. growth it far outpacing that of the rest of the developed world, and it is likely to continue to do so in the foreseeable future. We are by no means bearish on the U.S. stock market. In fact, we’ve argued that one can plausibly claim that U.S. stocks are in the early days of a long bull market (with the caveat that neither we nor anyone else has a crystal ball into the future).

For this reason, we maintain our positive outlook on risk assets, and on U.S. risk assets in particular. But for the time being, the dollar story seems to us to be moving in a negative direction. Largely based on this, we are increasing QuantStreet’s international allocations across all our risk levels to be closer in line to our benchmarks (which we consider to be target date funds). We’ve maintained a U.S. asset overweight since our launch, and we maintain a bit of an overweight still. However, we are closer to neutral than we’ve been at any time since our launch. You can see our performance numbers here.

As always, we’d love to hear from you. If you are considering working with us or have any questions about our approach, please reach out (see below). And we’re wishing all of our readers a happy and fulfilling new year!

Working with QuantStreet

QuantStreet is a registered investment advisor. It offers wealth planning, separately managed accounts, model portfolios and portfolio analytics, as well as financial consulting services. The firm’s approach is systematic, data-driven, and shaped by years of investing experience. To work with or learn more about QuantStreet, join our mailing list or contact us at hello@quantstreetcapital.com.

Please keep in mind that all financial forecasts are fraught with risk and uncertainty. Our views may prove incorrect and market outcomes may be materially worse than we anticipate. Please see our full disclosure about the limitations of financial forecasts and the risks of investing at https://quantstreetcapital.com/terms-of-use/.