December 10, 2025 –

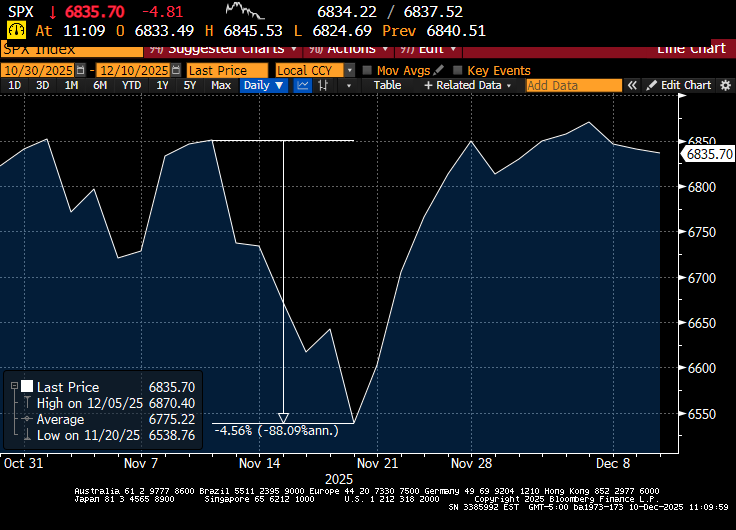

Markets had a mini swoon in November, on the back of AI bubble concerns (more on this below). But the recovery was quick and thus far in December tranquility has prevailed, as investors await news (later today) about the Fed.

A 25 basis point rate cut is widely anticipated, though Powell’s remarks at the press conference will set the tone for the market (at least for a few hours). Oracle, seemingly the poster child for the levered-AI-overinvestment thesis, is reporting after the market close today, so that will be another important data point for skittish investors.

After a rough start, markets managed to eke out small gains in November. You can see details about our performance here.

Angst

As a quick reminder, the prognosticators have proposed many narratives for how things might go awry in the future. Just yesterday, Howard Marks wrote in the Financial Times that the current market has bubble-like characteristics, thought he stopped short of calling it a bubble. And just this morning the Wall Street Journal warned us that “everyday investors [are] hedging against an AI bubble.” In case the bubble does pop (eventually), you have been forewarned.

The longer list of concerns includes the following items, though surely some have been left out:

- Long-term loss of reserve currency status by dollar;

- Steepening yield curve;

- Fiscal deficits and high government debt;

- Start of use of leverage to finance the AI buildout;

- Potential AI overinvestment;

- High valuations.

We acknowledge these are legitimate longer-term issues, as we’ve written about in our past letters (e.g., our October 2025 letter).

However, at the risk of sounding pollyannaish, we have also pointed out multiple positives that investors should consider (see our November 2025 letter):

- The building M&A cycle and deregulation;

- An accommodative (perhaps overly so) Fed (e.g., potential Hassett appointment as chair);

- Currently low corporate leverage;

- Huge AI investment demand.

We’ll learn bit more about two of these later today when the Fed announces its policy decision and when Oracle gives an update on the hyperscalers’ demand for AI infrastructure.

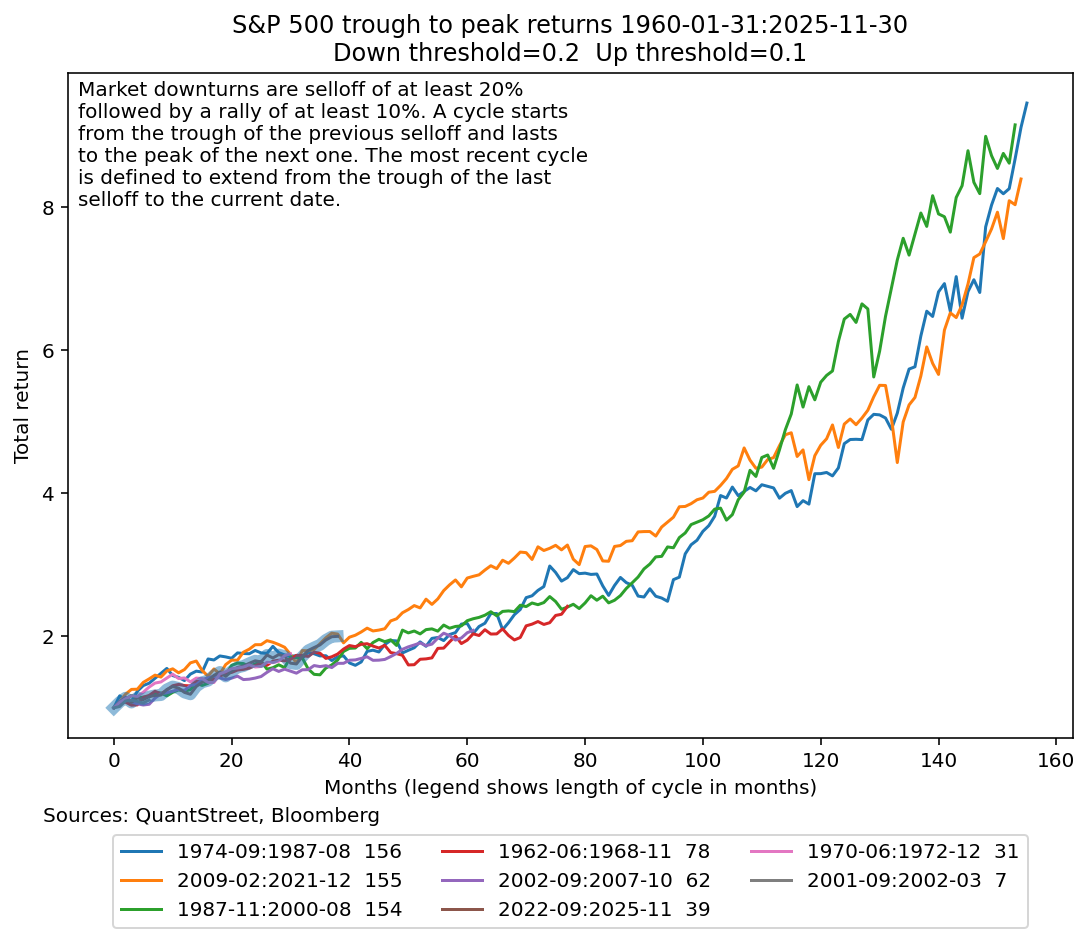

Market cycles

While we wait for these data points, let’s consider some recent work we’ve done at QuantStreet on the question of whether the current bull market cycle is long in the tooth. We define a bull market as starting in the month which represents the trough of the prior selloff, and lasting until the next cyclical market peak. Peaks are defined as the high point of the market prior to a 20% or higher correction, which is then followed by at least a 10% recovery (i.e., we don’t call it a selloff until the market has bounced 10% off the lows). We use monthly data for this analysis.

Using the above definition, the next chart shows the stock market’s performance over the eight bull market cycles we’ve had since 1960. The current one, which began with the market trough of September 2022 and which has lasted 39 months through the end of November 2025, is highlighted in blue.

This is not a forecast, but only an observation that:

- The current bull market is the best performer through the first 39 months among all bull markets since 1960, though the gap is not wide;

- There have been five bull markets (with durations ranging from 62 to 156 months) since 1960 which lasted longer than the current one;

- It is at least conceivable that the current bull market–despite the many negatives already mentioned–has a lot of room left to run.

The caveat is that these line-them-up analyses are hardly definitive, and we have criticized similar pictures ourselves in prior work. Nevertheless, we highlight the possibility that after a “mere” 39 months, there may yet be a lot of life left in the current bull market, especially if some of the rosier AI productivity and adoption forecasts pan out.

We’ll write more about this market cycle analysis in future pieces. If you’re interested in receiving these as soon as they come out, please consider signing up for QuantStreet’s Substack.

Working with QuantStreet

QuantStreet is a registered investment advisor. It offers wealth planning, separately managed accounts, model portfolios and portfolio analytics, as well as financial consulting services. The firm’s approach is systematic, data-driven, and shaped by years of investing experience. To work with or learn more about QuantStreet, join our mailing list or contact us at hello@quantstreetcapital.com.

Please keep in mind that all financial forecasts are fraught with risk and uncertainty. Our views may prove incorrect and market outcomes may be materially worse than we anticipate. Please see our full disclosure about the limitations of financial forecasts and the risks of investing at https://quantstreetcapital.com/terms-of-use/.