August 3, 2025 –

Some things change in markets and some don’t. The dollar partially reversed its year-to-date decline in July, and US equities had their first moment in the sun relative to international peers thus far in 2025. Some of the year’s biggest winners–European and international equities, and global bonds–turned into July laggards. The one market dynamic seemingly impervious to change, however, is the (somewhat perplexing) bitcoin rally, which saw the cryptocurrency up another 8.5% in August.

July’s market performance can be understood in the context of two observations. Thus far, President Trump’s trade wars have not had nearly their predicted impact on growth or on inflation. In fact, based on the reaction of some on the continent, the Trump administration may credibly claim to have engineered a trade pact with the EU that is, on net, beneficial to US interests.

QuantStreet continues to be overweight in US assets relative to asset allocation fund benchmarks. We maintain this overweight going into August. You can see our July performance here.

Cracks

Despite July’s strong market actions, cracks are starting to show. The one trading day thus far in August was not pretty. The market finished down 1.6% from its Thursday close, and down 2.8% from Thursday’s intraday high.

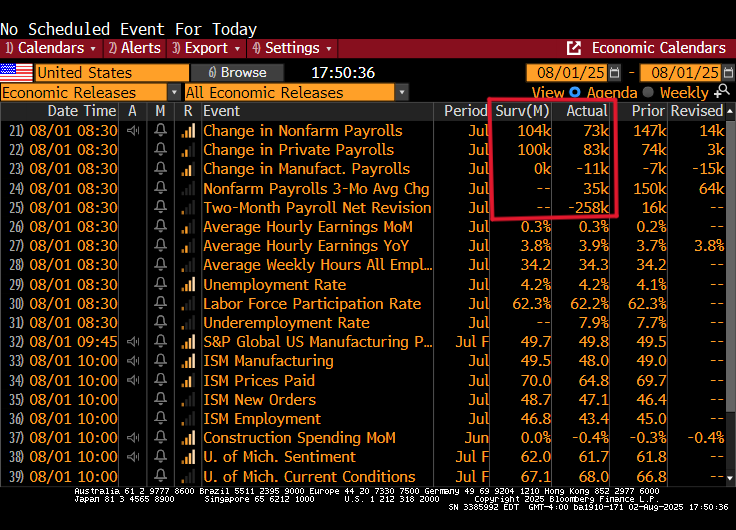

This was in response to a very weak nonfarm payrolls number on Friday morning, accompanied by a large negative revision to prior payroll releases. So large and unexpected were this data release and revision, that President Trump fired the head of the Bureau of Labor Statistics, which is in charge of the payrolls report. (This move has generated a fair amount of political pushback, including from members of Trump’s own Republican party.)

Whether this move is a blip or indicative of a real macroeconomic slowdown remains to be seen. What seems likely, however, is that markets will be in a state of uncertainty for the foreseeable future. With last week’s FOMC meeting in the rearview mirror, there won’t be any help from the Fed until it makes its next policy decision on September 17th. If the data over the next several weeks support the slowdown scenario, the Fed will likely act in mid-September by cutting rates. Friday’s 27 basis point drop in two-year Treasury yields suggests the market priced in one additional rate cut on the back of the weak payroll numbers. Barring a precipitous decline in economic activity–which seems unlikely as we discuss next–September is poised to bring good market news, either because the Fed will cut rates or because it won’t need to. But until then, the prognostications are likely to skew negative.

Macro overview

Advisor Perspectives carried a nice piece on Friday, discussing four data points that might give insight into whether a recession is imminent. We’ve already discussed the first of these, nonfarm payrolls. Taking a closer look shows that nonfarm payrolls are now approaching recessionary levels, though are still in the positive territory. But job growth is not happening at the heady rate of the 2010-2020 expansion. On the other hand, initial claims remain moderate. The economy isn’t generating a ton of new jobs, but neither is it seeing mass layoffs.

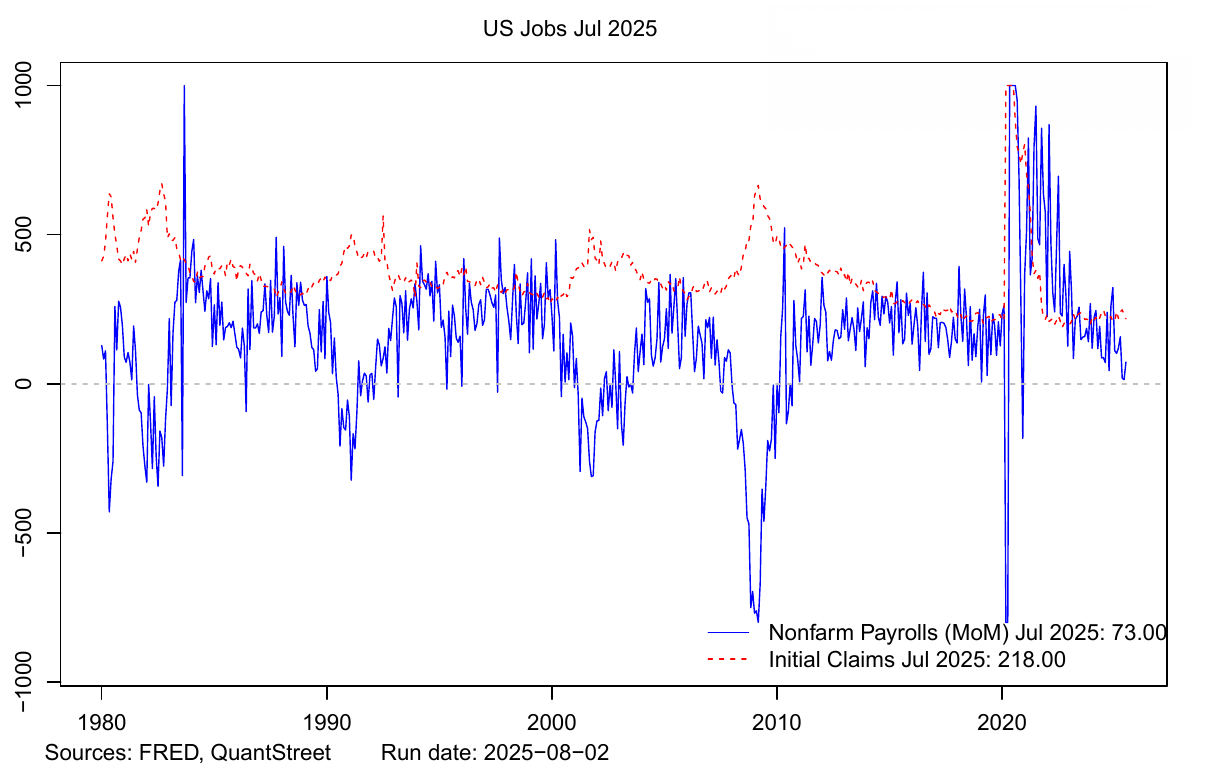

The other series from the Advisor Perspectives article are: industrial production, retail sales, and real personal income. The next chart shows the year-over-year percent change in all three, which tend to track one another closely. All are highly procyclical, doing well in good times and poorly in bad. All three are currently in positive territory, though not running in the mid-single digit range associated with past booms. The economy is growing, though perhaps not as robustly as in prior expansions.

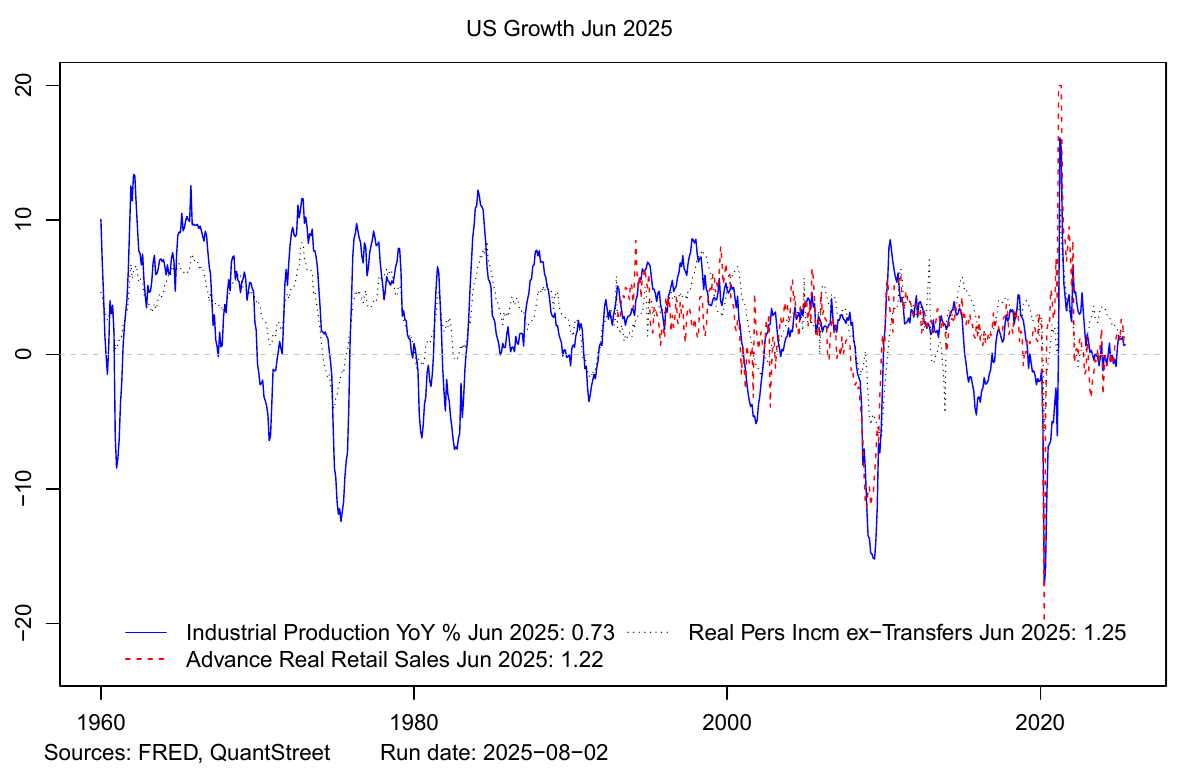

Consumer and business delinquencies paint a rosier picture. All delinquency series, except credit cards issued by small banks (which tracks a small borrower pool and appears non-representative), are benign, far below their levels during the global financial crisis of 2007-2009. The follow through is that bank balance sheets are in good shape, which should support credit provision to the economy.

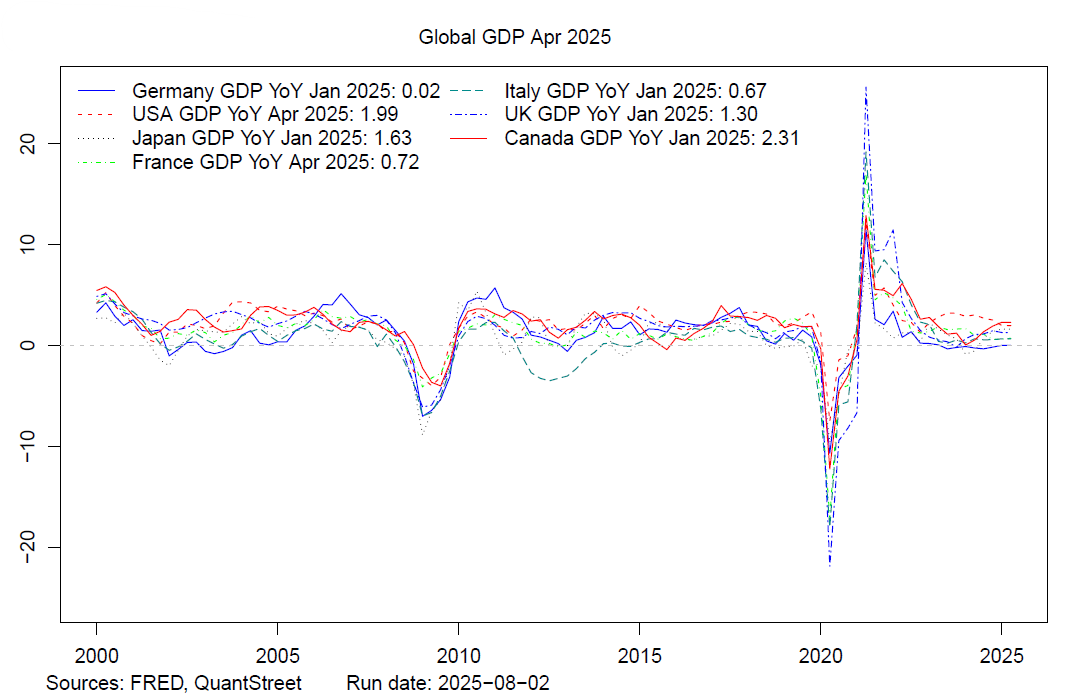

In the global context, however, US growth is robust. Of a group of major developed economies, the US and Canada are at the high end of GDP growth rates, with European economies barely eking out positive growth at all. This chart makes recent dollar weakness all the more surprising. Given the large interest rate differentials between the US and international markets (US rates are considerably higher), our view is the current dollar weakness is likely not sustainable (though many disagree).

Market implications

While the most recent payroll release was weak and potentially points to a delayed negative response to the Trump administration’s trade policies and general political uncertainty, other macroeconomic series are in decent shape. Our view is that the AI-productivity revolution is for real, and will lead to strong economic growth in the medium-term. But it is much harder to say whether a recession will or will not take place over the next quarter or two, though the fear of such a recession will now linger. In the short-term, markets are likely to be choppy because (1) the narrative of slowing economic growth will build until disproved by the data, and (2) while there is a Fed catalyst on the horizon, it is a month and half away.

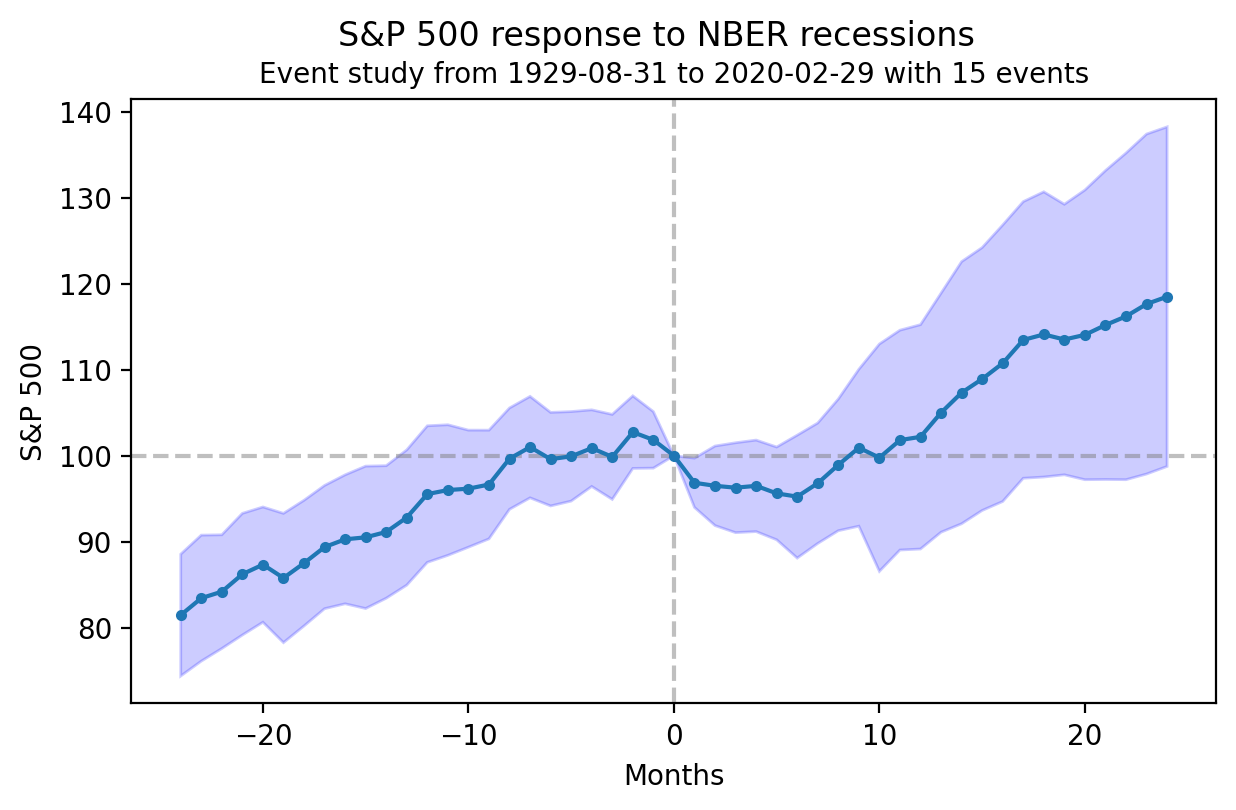

Should a recession arrive, it is not necessarily doom and gloom for stocks. In a piece we wrote two years ago, we showed that the average stock market response around NBER recessions involves a roughly 10% market drop from a peak reached a few months prior to a recession to the trough reached a few months after the recession’s start. However, in the two-year period following a recession start, the stock market tends to do well, showing a roughly 20% gain from the recession start on average.

For the time being, we slightly decreased the risk allocations of all our portfolios (by lowering the allowable tail risk threshold at each portfolio risk level without changing the local risk limits). We believe this reorientation can be done without sacrificing much (if anything) on the expected return side. Generally, we maintain our bullish view of the stock market’s prospects and of US assets in particular.

Working with QuantStreet

QuantStreet is a registered investment advisor. It offers wealth planning, separately managed accounts, model portfolios and portfolio analytics, as well as financial consulting services. The firm’s approach is systematic, data-driven, and shaped by years of investing experience. To work with or learn more about QuantStreet, join our mailing list or contact us at hello@quantstreetcapital.com.

Please keep in mind that all financial forecasts are fraught with risk and uncertainty. Our views may prove incorrect and market outcomes may be materially worse than we anticipate. Please see our full disclosure about the limitations of financial forecasts and the risks of investing at https://quantstreetcapital.com/terms-of-use/.